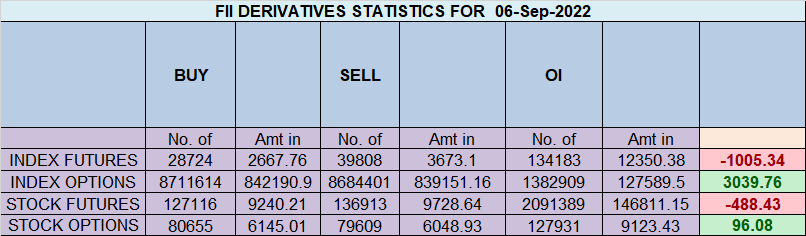

FII sold 11 K contract of Index Future worth 1005 cores, Net OI has increased by 1.8 K contract 4.6 K Long contract were covered by FII and 6.4 K Shorts were added by FII. Net FII Long Short ratio at 0.23 so FII used rise to exit long and enter short in Index Futures.

As Discussed in Last Analysis We got the big move as per expectation, NIfty is underperforming Bank Nifty and it can go on till 08-09 Sep when Astro cycle will change. Swing Trade Plan is Bullish above 17666 for a move towards 17731/17797/17863, Bears will get active below 17599 for a move towards 17533/17467/17401. Important Astro Dates strats from 08 Sep so tommrow can be another day with Voaltile moves like we saw today, Swing Trade Plan is Bullish above 17656 for a move towards 17723/17791/17858, Bears will get active below 17589 for a move towards 17522/17455.

Intraday time for reversal can be at 10:17/11:49/12:37/1:59/2:22 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17700 PCR at 0.81 PCR below 0.85 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 45 lakh contracts was seen at 17800 strike, which will act as a crucial resistance level and Maximum PUT open interest of 35 lakh contracts was seen at 17500 strike, which will act as a crucial Support level

Nifty Sep Future Open Interest Volume is at 1.28 Cores with liquidation of 0.20 Lakh with increase in cost of carry suggesting Long positions were closed today.

Nifty rollover cost @ 17655 and Rollover @76.6 % Closed above the rollover level suggesting bias is Bullish

FII bought 45.1 K CE and 66.8 K CE were shorted by them. FII bought 37.1 K PE and 17.8 K shorted PE were covered by them. Bias Bullish

Retailers bought 564 K CE and 400 K CE were shorted by them. Retailers sold 46.1 K PE and 73.8 K PE were shorted by them. Bias Bearish

FII’s bought 1144 cores and DII’s bought 632 cores in cash segment.INR closed at 79.95

#NIFTY50 READY for another 500 points move as per musical octave 18058- 17551-17044 take the side and ride the move !!

Sir how to find intraday reversal times