FII sold 88 contract of Index Future worth 7 cores, Net OI has increased by 16.6 K contract 8.2 K Long contract were added by FII and 8.3 K Shorts were addedby FII. Net FII Long Short ratio at 1.38 so FII used rise to enter long and enter short in Index Futures.

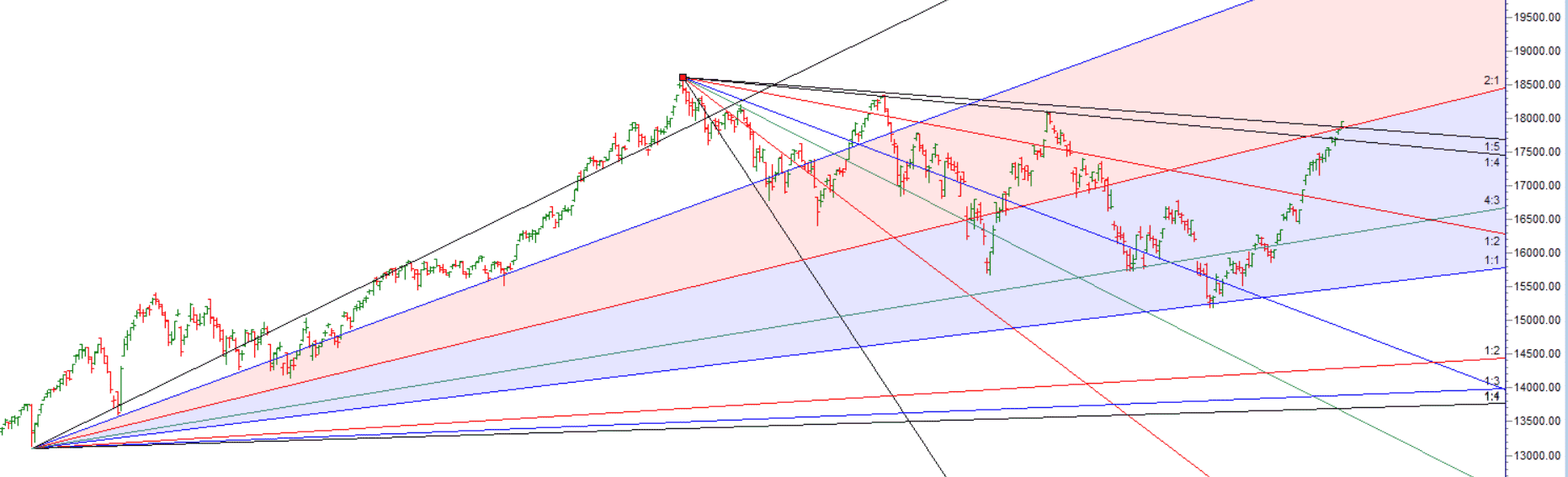

Bank Nifty has seen one of the Biggest Rally of 2022 with Index rising Non Stop from 16348 till 17965 almost a 600 points rally in just 15 trading sessions as Sun Conjunct Mercury showed its impact Tommrow Venus Trine Jupiter its important from gold and stocks specially banks. 17860-17866 is important zone Shorts should be taken below 15 mins candel sustained. For Swing Traders Bulls need to move above 18001 for a move towards18062/18128. Bears will get active below 17860 for move towards 17796/17730.

Intraday time for reversal can be at 9:29/10:57/11:30/12:03/1:06/2:35 How to Find and Trade Intraday Reversal Times

MAX Pain is at 17800 PCR at 0.95 PCR below 0.87 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Maximum Call open interest of 78 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level and Maximum PUT open interest of 73 lakh contracts was seen at 17800 strike, which will act as a crucial Support level

Nifty Aug Future Open Interest Volume is at 1.06 Cores with liqudiation of 1.4 Lakh with decrease in cost of carry suggesting Long positions were closed today.

Nifty rollover cost @ 16670 and Rollover @67.7 % Closed above the rollover level suggesting bias is Bullish

Its Basic Human Nature, Markets are up Traders want to Short Market are down traders want to Buy and this particular Emotions are exploited by Smart Money and Current Rally is classic Example,Many traders are losing on their shorts and market keep going up everyday.

Retailers have bought 122 K CE contracts and 163 K CE contracts were shorted by them on Put Side Retailers bought 588 K PE contracts and 503 K PE shorted contracts were added by them suggesting having BULLISH outlook,On Flip Side FII bought 49.9 K CE contracts and 30.6 K CE were shorted by them, On Put side FII’s bought 69.8 K PE and 27 K PE were shorted by them suggesting they have a turned to neutral Bias.

FII’s bought 2347 cores and DII’s sold 510 cores in cash segment.INR closed at 79.51

#NIFTY50 READY for another 500 points move in next 4 trading session as per musical octave 16108-16573-17066 take the side and ride the move !! — 17559 done now waiting for 18067.