FII bought 4.2 K contract of Index Future worth 344 cores, Net OI has decreased by 10.1 K contract 2.9 K Long contract were covered by FII and 7.2 K Shorts were covered by FII. Net FII Long Short ratio at 0.28 so FII used fall to exit long and exit short in Index Futures.

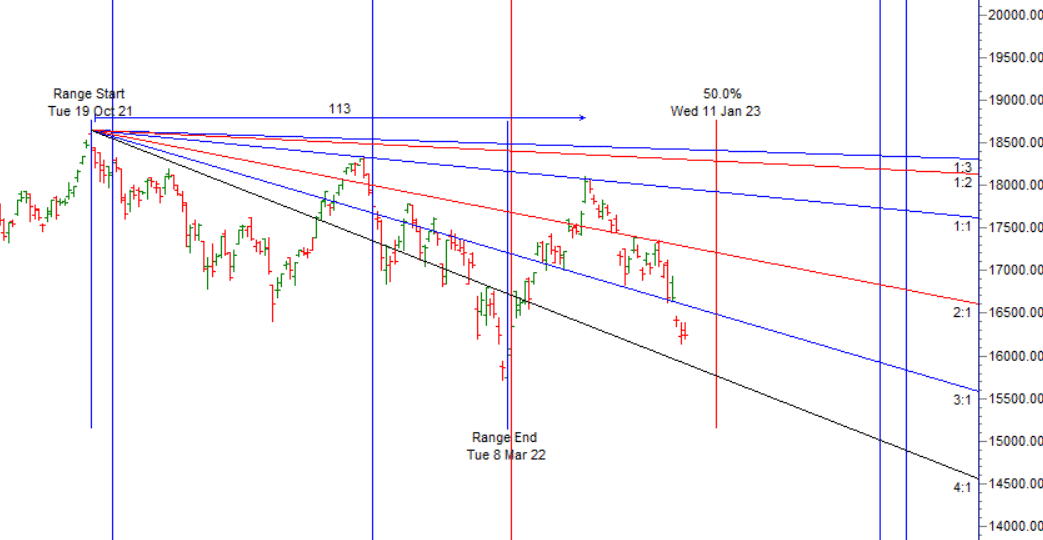

As Discussed in Last Analysis Tommrow we have 2 Important Astro date Jupiter Ingress and Mercury Retrograde so we can see potential reversal in the market. For Swing Traders Bulls need to move above 16333 for a move towards 16396/16458/16523/16589. Bears will get active below 16269 for a move towards 16205/16142/16077. Bulls were able to do 1 target on upside and Bears were able to do 2 target on downside. We have formed a Gravestone Doji candel and double top at 16404. Bulls need a close above16404 for a move towards 16459/16523/16586. Bears will get active below 16211 for a move towards 16147/16083/16019.

Intraday time for reversal can be at 9:23/9:58/12:12/1:31/2:31 How to Find and Trade Intraday Reversal Times

MAX Pain is at 16300 PCR at 0.92 , Rollover cost @17121 closed below it and rollover @65.6 lowest in 3 months. PCR below 0.9 and above 1.3 lead to trending moves, and in between leads to range bound markets.

Nifty May Future Open Interest Volume is at 1.02 Cores with liquidation of 7.2 Lakh with increase in cost of carry suggesting LONG positions were closed today.

The option table is undergoing a real transformation – with each day one CE level is targeted with huge volumes of writing and the strike is giving way to much lower strikes.

FII’s sold 3960 cores and DII’s bought 2958 cores in cash segment.INR closed at 77.60

Bayer Rule 1: The trend changes when Mercury changes its direction.Mercury goes in Retrograde. so Bulls need a close above 16404 for trend change to happened.

We are seeing fall across all Assets Class and Sentiment in extremly negative and Sell at 2 PM have become a crowded trade, Market follow path of least resistance so do not be biased at current jucture be ready to flip sides based on levels.

Retailers have bought 256 K CE contracts and 259 K CE contracts were shorted by them on Put Side Retailers bought 145 K PE contracts and 192 K PE shorted contracts were added by them suggesting having BEARISH outlook,On Flip Side FII bought 26.7 K CE contracts and 23.8 K CE were shorted by them, On Put side FII’s bought 44.1 K PE and 23.8 K PE were shorted by them suggesting they have a turned to NEUTAL Bias.

Trading is not easy to do, but becoming a trader is easy. There are no obstacles whatsoever to anyone opening a trading account.

For Positional Traders Stay long till we are holding Trend Change Level 16778 and stay short below it. That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 16315 will act as a Intraday Trend Change Level.