As Discussed in Last Analysis Important Astro Dates strats from 08 Sep so tommrow can be another day with Voaltile moves like we saw today, Bank Nifty bulls also failed to close above last swing high of 39759 formed on 19 Aug. Swing Trade Plan is Bullish above 39673 for a move towards 39873/40073/40225, Bears will get active below 39473 for a move towards 39273/39072/38872. We have important Aspect tommrow of Moon and Saturn as discussed in below video. First 15 Mins HIgh and Low should decide the trend of the market. Swing Trade Plan is Bullish above 39673 for a move towards 39873/40073/40225, Bears will get active below 39273 for a move towards 39072/38872.

Intraday time for reversal can be at 09:25/10:08/11:50/12:36/1:10/2:15 How to Find and Trade Intraday Reversal Times

Bank Nifty rollover cost @ 38918 and Rollover @73.2 % Closed above the rollover level suggesting bias is Bearish.

Bank Nifty Sep Future Open Interest Volume is at 19.6 lakh with Liquidation of 1.5 Lakh contract , with increase in Cost of Carry suggesting long positions were closed today.

Many people know that FII’s control the ebb and flow of the markets, but what many people do not read is the trades executed by these institutions in futures and options which have a large bearing on the immediate trend.

As per Musical Octave 39546 is Pivot Above it rally towards 40689 Below it 38404 .

Maximum Call open interest of 38 lakh contracts was seen at 39800 strike, which will act as a crucial resistance level and Maximum PUT open interest of 39 lakh contracts was seen at 39200 strike, which will act as a crucial Support level

MAX Pain is at 39500 and PCR @0.9 . PCR below 0.95 and above 1.3 lead to trending moves, and in between leads to range bound markets.

“Let the market tell you what you are going to make. Anytime you say ‘I have to…’ you’re in for potential trouble. Remember: The market doesn’t care about you.”

For Positional Traders Trend Change Level is 39406 on Futures go long and short above/below it That will help you stay on the side of Institutions and which has a greater risk-reward ratio. For Intraday Traders 39554 will act as a Intraday Trend Change Level.

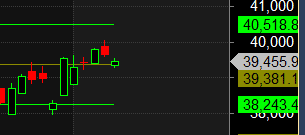

Buy Above 39729 Tgt 39819, 39972 and 40125 (Bank Nifty Spot Levels)

Sell Below 39462 Tgt 39260 39108 and 38953 (Bank Nifty Spot Levels)

Upper End of Expiry : 39993

Lower End of Expiry : 39190