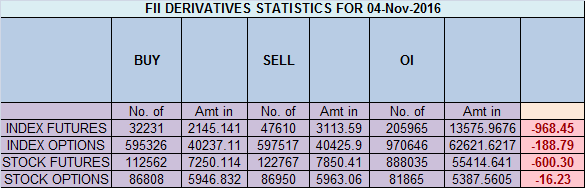

- FII’s sold 15.3 K contract of Index Future worth 968 cores ,7.3 K Long contract were liquidated by FII’s and 8 K short contracts were added by FII’s. Net Open Interest increased by 705 contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. Arrogance, in varied degrees, before the fall starts

- As discussed last Analysis now 8448-8444 level if and when it comes is very strong support zone, holding the same we can see a very sharp recovery, breaking the same we can correct till 8200,We are going in the demand zone so its prudent to cut short and do fresh shorting only below 8400 level, As we have US election overhand till 09 Nov its prudent to trade less,Long can be taken in range of 8444-8476 if and when it comes with strict sl of 8420 expecting a recovery till 8520/8600. Low made was 8400 so bulls who took trades got stopped out Nifty close at 8434 is at very crucial level, Longs above 8450 can see fast move till 8500/8600. Short below 8400 can see fast move till 8287. Best strategy would be to stay on sidelines and wait till election hangover is over by Wednesday. Bank Nifty forms ABCD Pattern,EOD Analysis

- Nifty Nov Future Open Interest Volume is at 1.72 core with addition of 2 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @8705 made high at 8704 on Tuesday and correction of 200 points.

- Total Future & Option trading volume was at 2.89 Lakh core with total contract traded at 1.2 lakh , PCR @1.03 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 60 lakh, resistance at 9000 .8500/9000 CE added 22.9 lakh so bears added in 8600-8800 range .FII sold 3.5 K CE longs and 26.6 K CE were shorted by them .Retail bought 65.1 K CE contracts and 15.9 K CE were shorted by them.

- 8400 PE OI@41.1 lakhs having the highest OI strong support at 8400. 8500-9000 PE liquidated 6.2 Lakh in OI so bulls ran for cover in 8500-8600 PE. FII bought 40 K PE longs and 12 K PE were shorted by them .Retail bought 2.9 K PE contracts and 41.7 K shorted PE were covered by them.

- FII’s sold 343 cores in Equity and DII’s bought 1090 cores in cash segment.INR closed at 66.71

- Nifty Futures Trend Deciding level is 8475 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8598 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8450 Tgt 8475,8500 and 8530 (Nifty Spot Levels)

Sell below 8400 Tgt 8385,8350 and 8300 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

Thanks for suberb analysis. You mentioned that “Retail bought 2.9 K PE contracts and 41.7 K shorted PE were covered by them.” My findings are that 41.7 K PE were shorted by them. Kindly confirm as my findings are different.

thanks sir. data is correct..

Cash market volume most likely includes some portion of block deal in L&T. Please see if any adjustment will be required.

sure will check it thanks..

great analysis as always,thank you.

thnaks..