Last week we gave Chopad Levels of 8840 and discussed nifty is ready for pre budget rally but last week Nifty on Weekly basis has the smallest range in past 15 years. Weekly Range was just 120 points and the expected Pre Budget rally was not seen. We saw a roller coaster ride in last week with Nifty and Bank Nifty swinging wildly and both indices in small range. Coming week has 6 trading session as market will remain open on Saturday as Union Budget will be presented. I have discussed which traders can use as an Input to their trading plan for coming week Stock Market Response to past Union Budget and Option Trading Strategy for Union Budget 2015 .Lets analyze how to trade next week.

Nifty Hourly Chart

Nifty Hourly charts has taken support at its 21 HEMA on downside and is near strong trendline resistance on upside from where Nifty has turned back 2 times before, Closing above the same will lead to short covering and market moving towards All time High of 8996. Unable to cross dip can be seen till 8700 odd levels.

Nifty Hourly Elliot Wave Chart

Elliot wave chart on Hourly is shown above suggesting 8806 will play a crucial role in coming week.

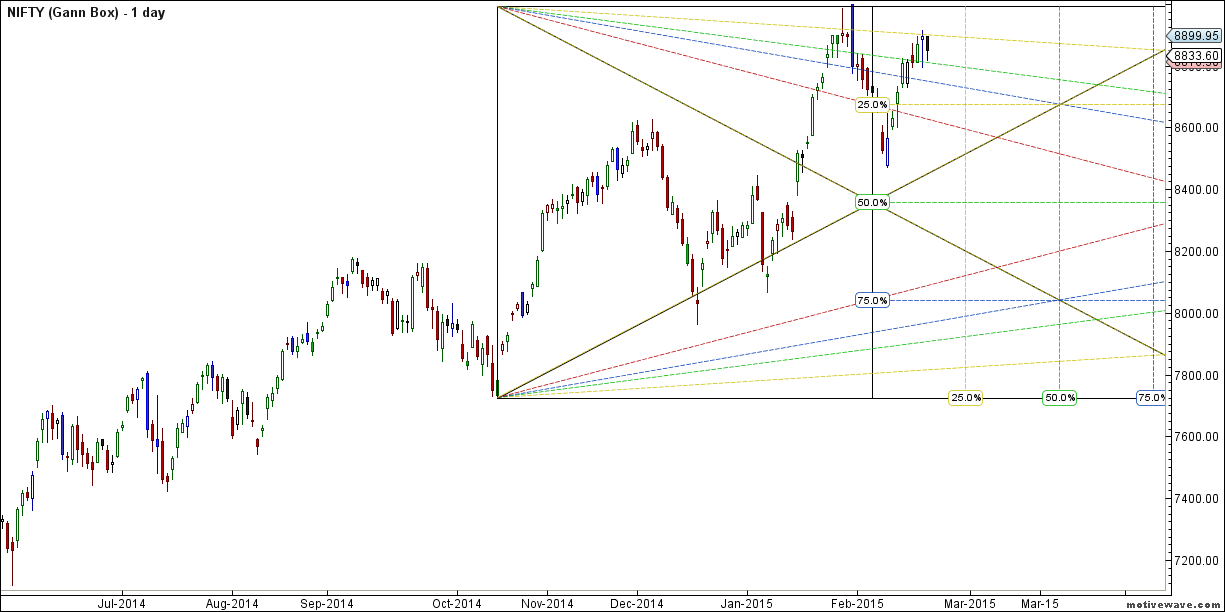

Nifty Gann Box

Nifty is stuck in green and yeallow line of gann box, price action near this should be closely watched. Breaking of Yeallow line @8920 will lead to breakout on upside and break of green line can see 8700/8650 on downside.

Nifty Harmonic Pattern

Nifty is forming a Butterfly pattern again unable to cross 8930 can lead to small pullback, any close above 8930 invalidates the pattern and nifty will march towards all time high.

Nifty Daily Elliot Wave Chart

As discussed in last week analysis As per EW more legs are left to the rally use dips around 8300/8400 to take exposure to quality large and mid caps stocks. Market gave the expected dip 2 weeks before and we saw swift recovery, hopefully traders and investors got oppurtunity to take exposure to stocks.

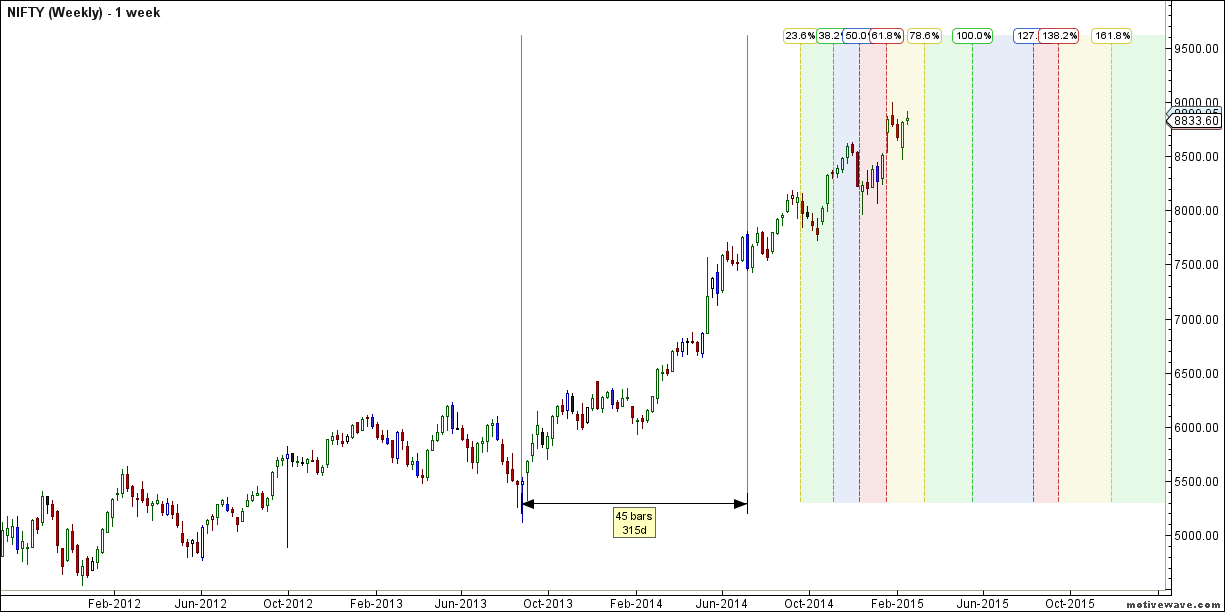

Nifty Gann Date

Nifty As per time analysis 24 Feb/28 Feb is Gann Turn date , except a impulsive around this dates. Last week we gave 18 Feb/20 Feb Day and Nifty saw a volatile move on both the days .

Nifty Gann Emblem

Nifty did not reacted to Gann Emblem date on 16 Feb last week went very neutral so can see big move in coming week.

Nifty Gaps

For Nifty traders who follow gap trading there are 7 trade gaps in the range of 7000-7800

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7526-7532

- 7598-7568

- 7625-7654

- 7780-7856

- 7927-7974

- 8029-8065

- 8378-8327

- 8102-8167

- 8277-8380

- 8711-8729

Fibonacci technique

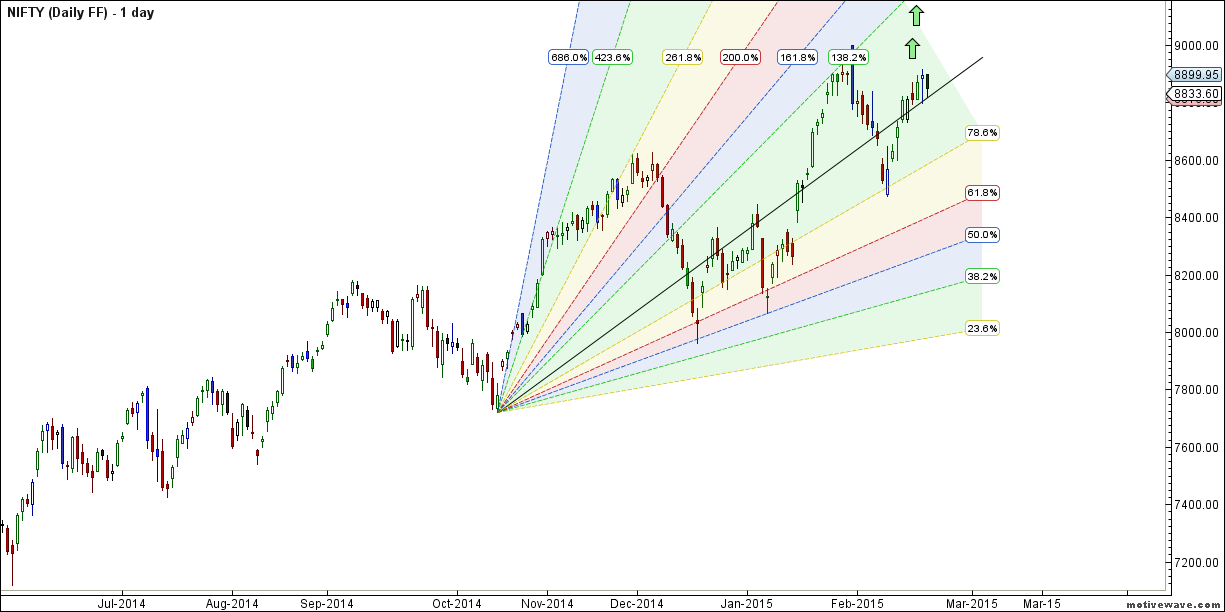

Fibonacci fan

Nifty took exact support @ gann fan and is now going towards higher end. As per Fibo retracement theory Nifty broke at 78.6% retracement @ 8884 and break above 8884 can see move towards 9000.

Nifty Weekly Chart

It was positive week, with the Nifty was up by 28 points closing @8833 forming a DOJI candelstick pattern, holding above 8920 heading towards trendline resistance on weekly basis. As per time analysis next week we can see big move.

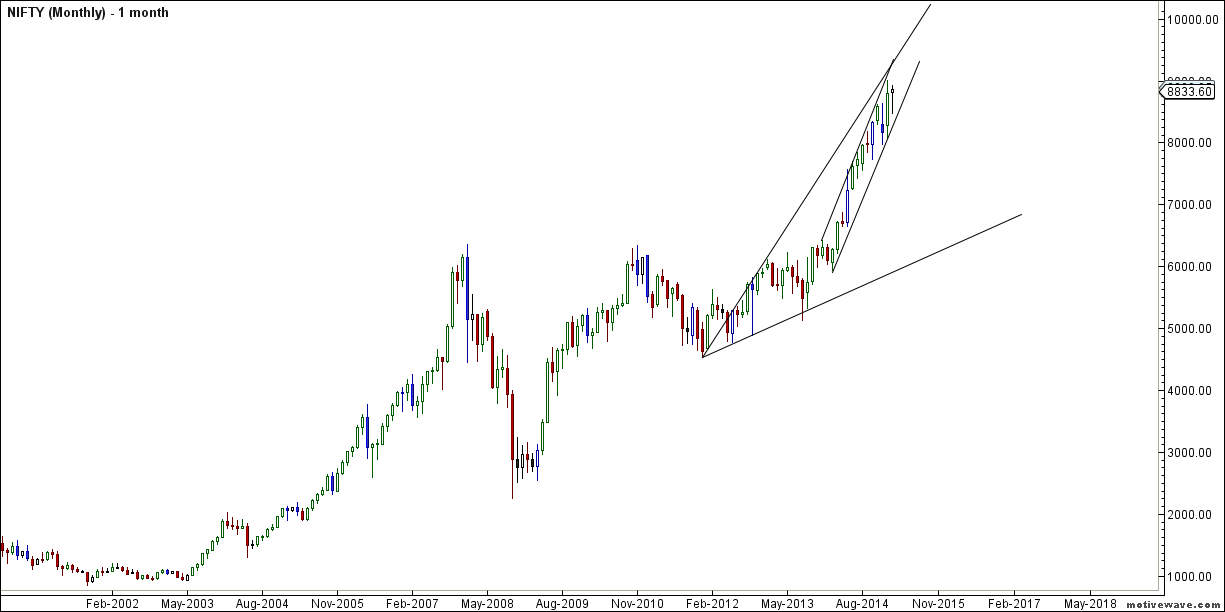

Trading Monthly charts

Nifty reacted from its lower trendline support of Monthly channel break of 8900 can see move towards 9200.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:8850

Nifty Resistance:8936,9066,9196,9300

Nifty Support:8780,8700,8650,8500

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Hello Bramesh, What will be the nifty range next 3 days… Today it was down around 80 points nifty and 100 points Nifty future…

Any upcoming news are there?

Any reason / News for down?

will this down trend continue tomorrow as well?? or any high big positive really will happen before expiry??

Please share your thoughts,

Thanks

Raj

THANKS A LOT SIR FOR THIS VALUABLE INFORMATION.

Thanks a lot Bramesh for detailed analysis report of Nifty based on different Technical Analysis methods. Do you see any possibility for decline in Nifty below 8473 in short term and Elliott Wave Counts are warning so?