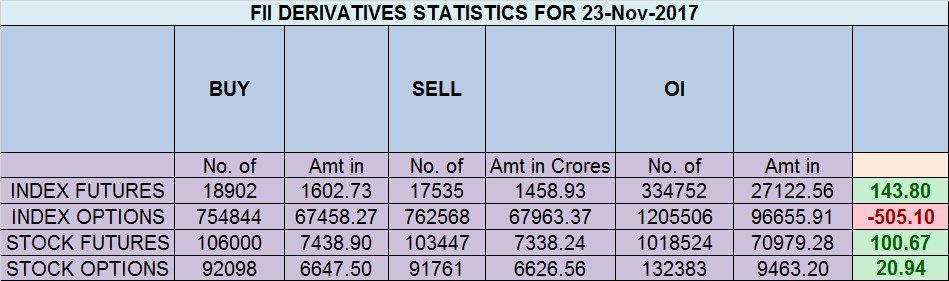

- FII’s bought 1.3 K contract of Index Future worth 143 cores ,874 Long contract were added by FII’s and 493 Short contracts were covered by FII’s. Net Open Interest increased by 381 contract, so rise in market was used by FII’s to enter long and exit short in Index futures. FII’s Long to Short Ratio at 1. Are you Victim of Sleep Disorder?

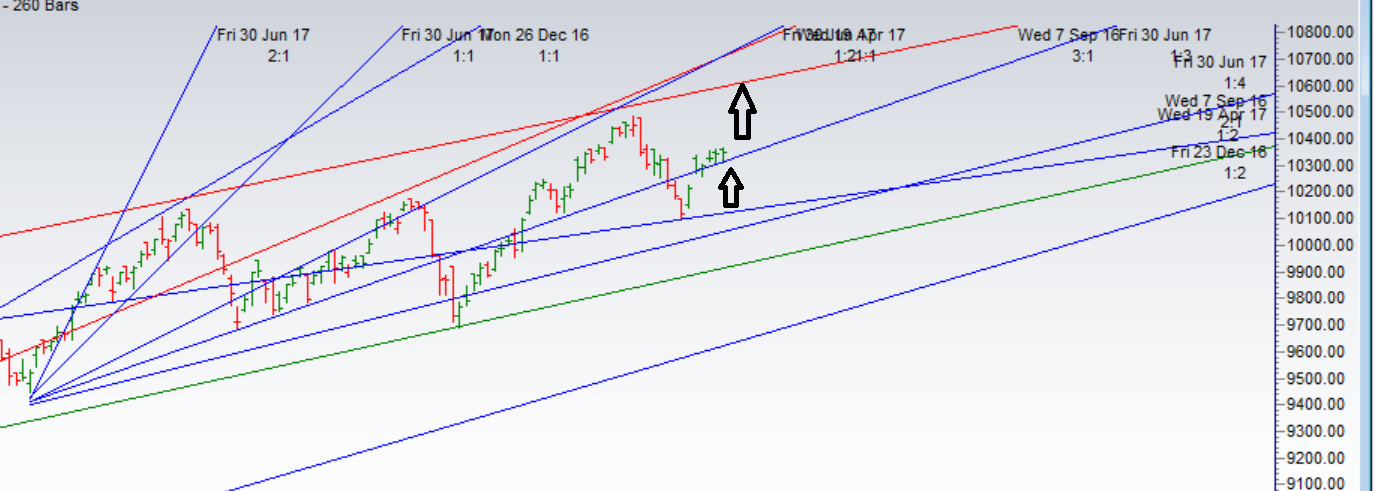

- As discussed in last analysis Bearish only below 10270 for a move towards 10200/10130/10090. Nifty closed above 10325 on Trend change date, Bullish above 10370 for a move towards 10420/10490/10525. Bearish below 10300 for a move towards 10230/10180. Low made today was 10307 so Bulls protected 10300 and High made was 10374 but did not sustain,bears protected 10370, so nifty trades between the high and low of trend change date and consolidation continues for 5 days, Testing time for traders, this kind of markets test the mental strength of traders those who survive with minimum loss and the ones rewarded in the next trending move, Whenever time cycle gets delayed by few days there will bigger move. Bullish above 10370 for a move towards 10420/10490/10525. Bearish below 10300 for a move towards 10230/10180. Bank Nifty continues its consolidation ,EOD Analysis

- Nifty Nov Future Open Interest Volume is at 2.11 core with liquidation of 5 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @10280 closed above it.

- Total Future & Option trading volume at 11.34 Lakh core with total contract traded at 1 lakh , PCR @0.80

- 10500 CE is having Highest OI at 62.9 Lakh, resistance at 10500 followed by 10600 .10000-10500 CE added 0.61 Lakh in OI so bears added major position in range of 10400-10500 . FII sold 9.6 K CE and 4.3 K shorted CE were covered by them. Retail sold 97.9 K CE and 84.9 K shorted CE were covered by them.

- 10300 PE OI@60 lakhs having the highest OI strong support at 10300 followed by 10200. 10000-10500 PE added 20 Lakh in OI so bulls added again in 10100-10300 PE as 10250 was held. FII sold 12.9 K PE and 4 K PE were added by them. Retail sold 43 K PE and 64.3 K shorted PE were covered by them.

- FII’s bought 73 cores and DII’s bought 222 cores in cash segment.INR closed at 64.57

- Nifty Futures Trend Deciding level is 10352 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 10345. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 10352 Tgt 10375,10395 and 10430 (Nifty Spot Levels)

Sell below 10335 Tgt 10310,10280 and 10260 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh