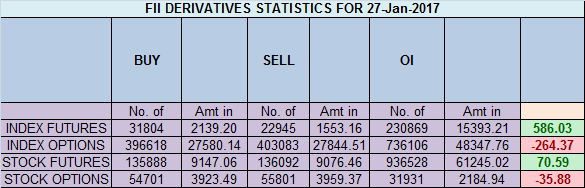

- FII’s bought 8.8 K contract of Index Future worth 586 cores ,17.7 K Long contract were added by FII’s and 8.8 K short contracts were added by FII’s. Net Open Interest increased by 26.5 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. King Raghu’s story

- As discussed in last analysis Gann Price and time Analysis helped traders to capture the move above 8432 till 8600 now bulls will head towards 8710 levles where there is resistance as shown in below chart, Bearish only on close below 8432 till 8432 is held we can move all the way towards 8969 over next 2 months. 8675-8700 is crucial resistance band as per gann angles as shown in below chart, further rally towards 8752/8806 as budget is coming on 01 feb so once 8700 crossed we can see fast move towards 8806/8840 range. Bearish only below 8432. Bank Nifty Continue to Rally,EOD Analysis

- Nifty Feb Future Open Interest Volume is at 1.93 core with addition of 12.2 Lakh with increase in cost of carry suggesting Long position were added today, NF Rollover cost @8468.

- Total Future & Option trading volume at 2.72 Lakh core with total contract traded at 1.14 lakh , PCR @0.81

- 9000 CE is having Highest OI at 36 lakh, resistance at 9000 followed by 8700 .8400-9000 CE added 3.9 Lakh in OI so bulls added in 8900/9000 CE .FII bought 20.4 K CE longs and 9.7 K CE were shorted by them .Retail bought 45 K CE contracts and 32 K shorted CE were covered by them.

- 8400 PE OI@36.7 lakhs having the highest OI strong support at 8400 followed by 8200. 8400-9000 PE added 21.7 Lakh in OI so bulls added in 8400/8500 PE. FII bought 16.6 K PE longs and 33.8 K PE were shorted by them .Retail bought 61.1 K PE contracts and 18 K shorted PE were shorted by them.

- FII’s bought 211 cores in Equity and DII bought 482 cores in cash segment.INR closed at 68.03

- Nifty Futures Trend Deciding level is 8676 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8626. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8650 Tgt 8673,8700 and 8740 (Nifty Spot Levels)

Sell below 8605 Tgt 8575,8550 and 8520 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Brahmeshji,

THE ADSENSE NEED TO KNOW THAT durex AD ON YOUR WEBSITE DOES NOT STOP WHEN CLICKED ON STOP BUTTON AND KEEPS ON REPLAYING. tHIS IS VCERY UPSETTING. I shall close your website

Dear Sir,

Ad sense shows the add based on user preference. If i search about a Holiday I will see adds related to Holiday. I have no control over this.