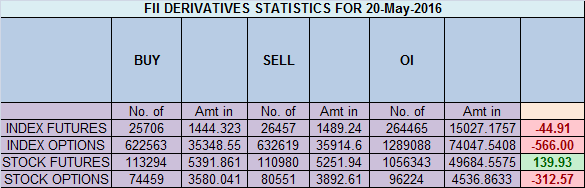

- FII’s sold 751 contract of Index Future worth 44.9 cores ,4.1 K Long contract were liquidated by FII’s and 3.3 K short contracts were liquidated by FII’s. Net Open Interest decreased by 7.5 K contract, so fall in market was used by FII’s to exit long and shorts in Index futures.Impossible Is Nothing

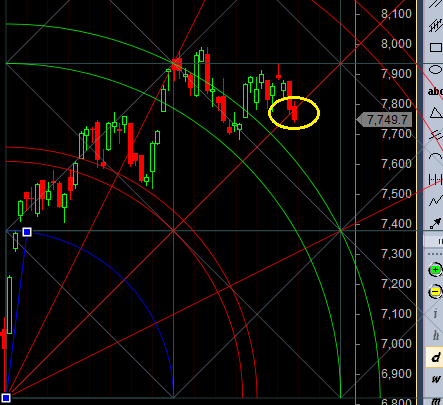

- As discussed in last analysis Close below 7777 can see nifty going till 7678/7546 in coming session, We got the close below 7777, and also close below gann trendline. If we move above 7777, again we can move above 7850. So 7678 and 7777 are 2 levels to be watched in coming week. Bank Nifty close below 16500,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.56 core with liquidation of 8.7 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @7953, High made on 17 May was 7957 and we are down almost 200 points from 7953 which was rollover cost.

- Total Future & Option trading volume was at 3.21 Lakh core with total contract traded at 1.62 lakh , PCR @0.80, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 94.7 lakh, resistance at 8000 .7500/8000 CE added 18.4 lakh so bears added aggressively today as bulls were not able to protect 7777 .FII bought 131 CE longs and 10.4 K CE were shorted by them .Retail bought 32.5 K CE contracts and 10 K CE were shorted by them.

- 7700 PE OI@52 lakhs having the highest OI strong support at 7700. 7300-7800 PE liquidated 1.9 Lakh in OI so strong base near 7500-7600 zone .FII bought 5.6 K PE longs and 5.3 K PE were shorted by them .Retail sold 407 PE contracts and 8.5 K shorted PE were covered by them.

- FII’s sold 743 cores in Equity and DII’s bought 597 cores in cash segment.INR closed at 67.45

- Nifty Futures Trend Deciding level is 7792 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7845 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7770 Tgt 7796,7815 and 7850(Nifty Spot Levels)

Sell below 7715 Tgt 7690,7670 and 7640 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

So this week it has to be short only…..expiry will see 7640 level. Right sir?

As a trader we need to be flexible with expectation and “RIGID” with risk management..