- Dear All, I got caught up with some urgent, unavoidable work, which kept me away from posting on site from last 2 days, I thanks all my lovely readers for their concern via different means of communication. Inconvenience caused is regretted.

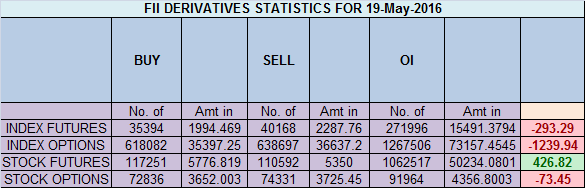

- FII’s sold 4.7 K contract of Index Future worth 293 cores ,3.1 K Long contract were liquidated by FII’s and 1.6 K short contracts were added by FII’s. Net Open Interest decreased by 1.4 K contract, so fall in market was used by FII’s to exit long and shorts were added in Index futures.Cella Quinn from Dishwasher to President of Investment Firm

- As we have been discussing about Time correction (Where Price remains in a small range over a period of time) in past few analysis, Nifty closed on 02 May @7805 and today close was 7783 so we have moved just 22 points in last 13 trading sessions. We are again near to gann trendline as shown in chart below, holding the same bounceback till 7900. Break below the same and close below 7777 can see nifty going till 7678/7546 in coming session Its one of the difficult phases for trend followers as market moving in no clear trend but such phases makes a trader strong both emotionally and mentally, traders who pass such phases without much loss of capital will be rewarded handsomely by market in coming time. Best way to trade market is Buy support sell resistance till the range of 7972-7678 is not broken. Bank Nifty move 22 points in 13 trading session,EOD Analysis

- Nifty May Future Open Interest Volume is at 1.64 core with addition of 4 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @7953, High made on 17 May was 7957 and we are down almost 180 points from 7953 which was rollover cost.

- Total Future & Option trading volume was at 3.29 Lakh core with total contract traded at 1.93 lakh , PCR @0.84, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 98.3 lakh, resistance at 8000 .7500/8000 CE added 59.7 lakh so bears added aggresively today as bulls were not able to protect 7850 .FII sold 9.4 K CE longs and 12.8 K CE were shorted by them .Retail bought 122 K CE contracts and 42.5 K CE were shorted by them.

- 7700 PE OI@56.7 lakhs having the highest OI strong support at 7700. 7300-7800 PE liquidated 14.6 Lakh in OI so strong base near 7500-7600 zone .FII bought 9.5 K PE longs and 7.9 K PE were shorted by them .Retail sold 32 K PE contracts and 6.9 K PE were shorted by them.

- FII’s sold 764 cores in Equity and DII’s bought 1484 cores in cash segment.INR closed at 67.36

- Nifty Futures Trend Deciding level is 7822 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7848 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7810 Tgt 7830,7850 and 7877 (Nifty Spot Levels)

Sell below 7766 Tgt 7741,7720 and 7700 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

brahmesh sir, Nifty Futures Trend Deciding level is 7822

thsi means nifty future level for intraday trading or nifty cash level

pls confirm

Its Nifty Future level

Bramhesh sir .i have 400 share of tata elxsi@2030.sml isuzu 100 shares @1070.nilkamal 100 shares@1318.sbi 1000 shares @235.i am already lost 3 lakhs rupees to shift to another stock..plz advise me what i have to do…plz bramhesh ji…

Dear Sir,

When you purchased these shares did you have SL or TGt is mind. Professional traders are working for you to do mistake and they can earn out of your losse.

3 lakh you lost use that experience as a learning tool and spend time on learning the tricks of trade rather than blindly doing trades.

Rgds,

Bramesh

THANK GOD,everything is fine.we missed ur updates very badly.actually ur blog and mkt. both complement each other.

thanks a lot !! Wishing you the best !!

Dear Bramesh ji, relieved to see you back. Was a but worried .

thanks a lot Saurabhji .. Just got stuck and had no time to update..

done thanks

Sir, banknifty EOD post showing nifty post kindly make it visible

sir its updated..

thanx sir, for ur post after gap of 2 days I do regularly read

As today is Gann turn date as u mentioned in ur earlier post so big move do come today?

Gann is on 21 may, so effect should come today or Monday

Thank god everything is fine..

yeah! I wished the same.

Thank you very much for your posts. Much appreciated. God bless.

hi sir ..good to know u r fine..god bless. !! sir plz send me a mail regarding ur course fees and topic covered..i am intrested in learning TA from u..thanks

can u give an example of trading journal ?? either in excel sheet or word doc.

thx.

Dear sir,

Without seeing your daily post, it’s not a trading day….

Hope everything fine from your side.

U R Back, cheers all the bramesh fans

Dear Sir,

Thanks for all the love and affection.

Rgds,

Bramesh

Gm sir Thank sir your nifty update

Hope all fine sir…thank u for your post

Dear Bramesh Sir,

M Sure That everything is fine with u as people like u would not face any issues because of lots of love & good wishes of ur fans r there with u. And specially people like u who r spreading a light of knowledge to so many traders, God will take due care of u and will bless u.

GREAT TO SEE U BACK.