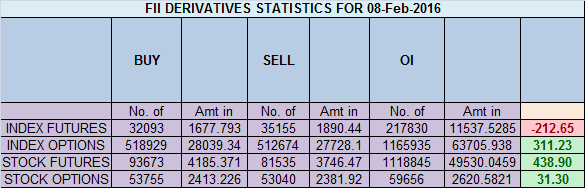

- FII’s bought 3 K contract of Index Future worth 212 cores ,1.5 K Long contract were liquidated by FII’s and 1.5 K short contracts were added by FII’s. Net Open Interest decreased by 3 K contract, so fall in market was used by FII’s to exit long and enter shorts in Index futures. How To Improve Trading Success

- As discussed in Last Analysis We need to close above 7504 for next move till 7556. Any close above 7600 on Weekly basis will see change in trend for a bigger swing towards 7970. Support at lower level is 7420/7366, High made was 7512 and we saw correction in last 1 hour but made low of 7363,Nifty did nothing for the whole day big fall came in last 1 hour, early indication we got when nifty was unable to close above gann arc and also VIX was increasing. If we close below 7366 it mean high propbablity of nify break 7230,if we make low in range of 7318-7292 and bounce back than we might be forming BAT pattern as discussed in weekly analysis which will have bullish implication going forward. Bank Nifty corrects from Pyrapoint Resistance,EOD Analysis

- Nifty February Future Open Interest Volume is at 1.93 core with addition of 8.1 Lakh with decrease in cost of carry suggesting short position were added today, Nifty Future closed below the Rollover cost @7419.

- Total Future & Option trading volume was at 2.32 Lakh core with total contract traded at 1.8 lakh , PCR @0.82 .How To Identify Market Tops and Bottom

- 7600 CE OI at 66.1 lakh , wall of resistance @ 7600 .7400/8000 CE added 33.2 lakh in OI addition was seen by bears major addition was seen in 7500/7600 CE .FII bought 0.005 K CE longs and 13 K shorted CE were covered by them .Retail bought 58.1 K CE contracts and 16.5 K CE were shorted by them.

- 7400 PE OI@48.6 lakhs having the highest OI strong support at 7400 . 7300/8000 PE liquidated 10 lakh so bulls ran for cover as Nifty unable to cross above the gann arc .FII bought 17.4 K PE longs and 1.7 K shorted PE were covered by them .Retail sold 28.8 K PE contracts and 4.5 K PE were shorted by them.

- FII’s sold 84 cores in Equity and DII’s bought 279 cores in cash segment.INR closed at 67.93

- Nifty Futures Trend Deciding level is 7464 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7482 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7390 Tgt 7420,7445 and 7479 (Nifty Spot Levels)

Sell below 7330 Tgt 7300,7270 and 7220 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates