Last week we gave Chopad Levels of 7555 , Nifty opened and made low of 7551 Chopad levels, Long Intitated on Monday were rewarded with all three target done by Wednesday.Lets analyze how to trade market in coming week. This will be the Last weekly analysis of 2015 as coming week due to personal commitments No Weekly and Daily Analysis will be published from 24 Dec-30 Dec.

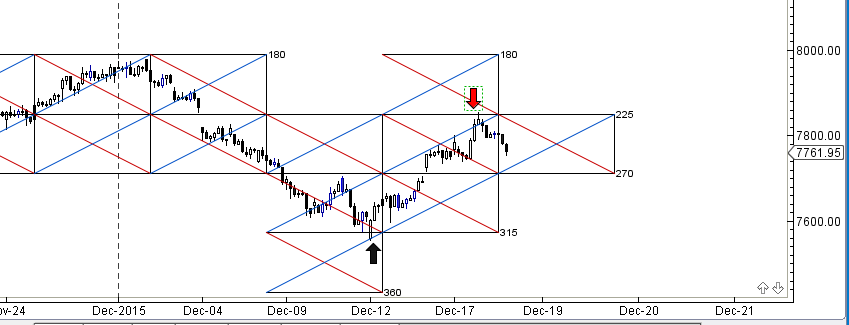

Nifty Hourly Chart

As discussed last week Nifty trading in pyrapoint angles in range of 270/315, break of any one of them will be see another move of 125 points so break of 7575 can lead to fall near 7400, holding 7575 can see move back to 7700

As discussed last week Nifty trading in pyrapoint angles in range of 270/315, break of any one of them will be see another move of 125 points so break of 7575 can lead to fall near 7400, holding 7575 can see move back to 7700

Nifty moved perfectly in pyrapoint angles and again approaching the 270 line, closing below it can again see nifty moving towards 315/360.

Nifty Harmonic

SHARK Pattern will be formed if we go near 7550/7530 and close above it, Below that the pattern will FAIL/INVALIDATED.

Low made 7551 and nifty made high of 7852 which almost near to the target of 7860.

Now 7738/7702 should be watched closing below this will increase porperblity of market breaking 7551 and 7539

Nifty Gann Angles

Nifty bounced from 7551 levels and rallied byt unable to close above the 1×3 line suggesting its will be short term resistance.Closing above 7860 is important for bigger move.

Nifty bounced from 7551 levels and rallied byt unable to close above the 1×3 line suggesting its will be short term resistance.Closing above 7860 is important for bigger move.

Nifty Supply and Demand

Self explanatory chart of Weekly Supply and Demand zone is shown,Weekly close below 7560 can have serious implication with Nifty falling as low as 7118. Nifty Weekly closing above 7921 can give Bulls edge.

Self explanatory chart of Weekly Supply and Demand zone is shown,Weekly close below 7560 can have serious implication with Nifty falling as low as 7118. Nifty Weekly closing above 7921 can give Bulls edge.

Nifty Gann Date

Nifty As per time analysis 23 Dec is Gann Turn date , except a impulsive around this dates. Last week we gave 17 Dec Nifty saw a volatile move.

Nifty Gaps

For Nifty traders who follow gap trading there are 15 trade gaps in the range of 7000-9000

- 7067-7014

- 7130-7121

- 7276-7293

- 7229-7239

- 7454-7459

- 7864-7821

- 7950-8005

- 8327-8372

- 8937-8891

- 8251-8241

- 8232-8209

- 8116-8130

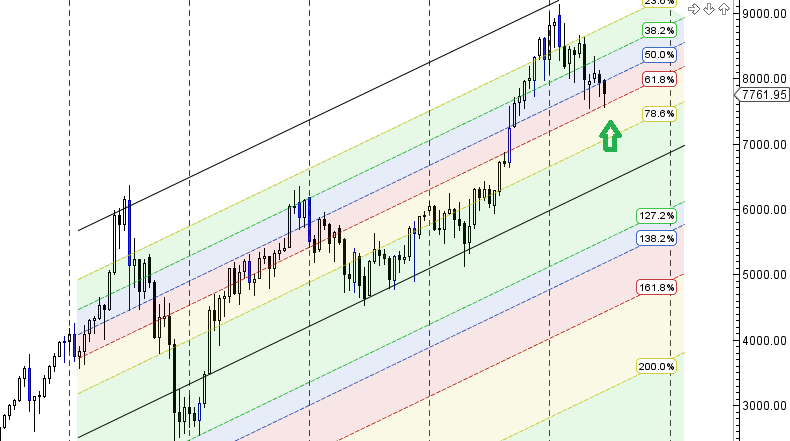

Fibonacci technique

Fibonacci Retracement

7842/7709 are levels to be watched in coming week.

Nifty Weekly Chart

It was positive week, with the Nifty up by 151 points closing @7762,unable to close above trendline and closing below its 20 WEMA and 55 WEMA and 100 WEMA .100 WEMA has supported last 6 time now now has failed suggesting beraish view till we do not go over it. Starting with new time cycle in coming week.

Trading Monthly charts

Trading Monthly charts

Monthly chart took resistance @50% and bounced from support near 61.8% retracement line.

Monthly chart took resistance @50% and bounced from support near 61.8% retracement line.

Nifty PE

Nifty PE @20.99 , corrected from trendline resistance.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:7717

Nifty Support:7667,7590,7539

Nifty Resistance:7767,7836,7890

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

Sir, Your reviews were great during 2015 and it will be greater during 2016. I wish you and your family a very very Happy New Year 2016.

First target on upside achieved today…Thanks Sir.

I had a doubt….what should be the stop loss while trading Chopad Levels ?

Keep 20 Point SL and any time SL gets triggred 2 times in a day no further trade.

Also please make risk management as per your trading style.

Rgds,

Bramesh

Happy New Year Bramesh Ji !! I deeply respect your analysis and has helped me a lot during since I started reading it.

Your posts will be missed. But hope you have a great Holiday !

Thanks All for Good Wishes 🙂 Wishing Everyone a Happy and Profitable New Year Ahead !!

Wish you and all the traders here a Happy and Prosperous New Year.

Sir i am one of the new students of your website and highly impressed . Please guide me about the chopad levels . Suppose if I enter for the same what will be the stop losses

Keep 20 Point SL and any time SL gets triggred 2 times in a day no further trade.

Also please make risk management as per your trading style.

Rgds,

Bramesh

Thanks a lot Bramesh…Wishing you a prosperous new year…

thanks for analysis , helped me a lot … have a great new year

regards

Kamaldeep Singh

Happy New year Sir….

Thank you for the terrific analysis in 2015 and wish you the best for a great 2016. I think something of real concern is the India Vix, it is behaving very similar to what we saw in August. It is now 5 points below the US Vix. This happened in August and the India Vix suddenly spiked from 15-35 as the market crashed. Wont be surprised to see the market break 7550 and head near 7300 very soon.

Tx Bramesh,

I agree and thank you for your view points.

I also analyze based on last 24 Hour Analysis of the Stock Markets:

FED:

Fed increased rates and this is a strong signal, that money will now move away from stocks into other areas of economy, no need to support the stock market and the financial markets.

DOW:

Will crack and already started the journey down, a 1000 point is a normal for last few months, now can it be a 3000 or a 4000 correction, placing the DOW in 12000 area, as far as my thought goes it is a good thing for DOW to take support in the area, as it is unable to cross 18000 despite all attempts.

INR:

Will try and go to the 65 or even 63/64 area, the reason being, that the fiscal situation seems to have improved in India, helped by Modi and Crude.Why 63/64 ?

Long term RSI studies will place a negative strength in the current move of the INR.

Last time it went there due to bad fiscal, it was strong, noew it is weak (RSI) due to a strong fiscal.

Good for Indian Markets.

USD:

This is the papa of all things financial, if a student does not know the reach and effect of it, then he is seriously wasting his time in this market. USD is now collecting strength…. to break 100 levels, It has paused to give the world time to adjust. But the days are ticking. Anything at anytime can trigger it off.

OIL:

With US allowing OIL Exports, the world will be flush with OIL !

$32 was 2008 low for OIL, can we think it will support this price or we can expect further cracks, historically $32 should hold and if it does not we are looking at $12 or $16 OIL. !!!

WOW that low ! Technical studies show that YES it is possible, but not likely to happen.

GOLD:

Gold is in a fix, it can neither move up or down, this is helpless condition it finds itself in. So gone are the days for Gold BULL, it might seem for a while as it’s biggest customer :INDIA has shifted to paper GOLD, the long term ramifications are huge, so till next Hindu New Year, let it chill.

do advice, what you think ?

Rgds

sir happy new year,

Happy new year in advance

we will miss your valuable articals for some days

Sir, Your reviews were great during 2015 and it will be greater during 2016. I wish you and your family a very very Happy New Year 2016. I am an ardent follower of your daily reports. I have the practice of scribling your daily views in a seperate note book, which is the guiding factor for my trades. Thanks a lot lot Sir.

Thank you very much sir for your knowledge sharing…………..Have a great time.

sir, when I click “Continue Reading” on your post about “Multi milliinior..”, I am getting page not found error. Please rectify the same.

Have a great time Sir…Thanks for all u do !!!

Thank God. Bless you Sir

Sir good morning , this is my first wkly study of your web site .please cont.it or give me suggestion for how to see your wkly view. Thank you.

Oh, no more daily analysis .

What is the way out?

From 23-30 Dec have some personal commitments will be continued in New Year 🙂

Happy New year Sir

BRAMESHJI – ADVANCE GREETINGS

With the grace of ALMIGHTY,

may forthcoming year

be filled with golden opportunities

and

fruitful endeavors,

leading you & all of us to a prosperous

and

successful

HAPPY NEW YEAR 2016