- FII’s sold 10.9 K contract of Index Future worth 645 cores ,5.2 K Long contract were liquidated by FII’s and 5.6 K short contracts were added by FII’s. Net Open Interest increased by 0.03 K contract, so today’s rise in market was used by FII’s to exit long and add shorts in Index futures Maintaining Trading Discipline; Easier Said Than Done

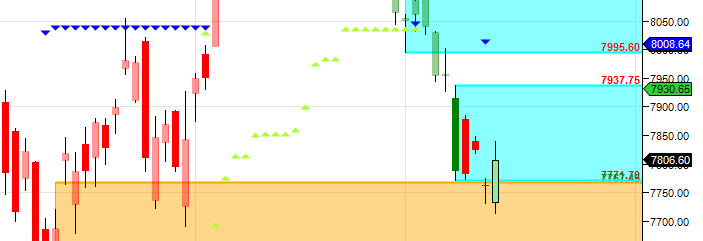

- As discussed in Last analysis , Nifty has corrected 606 points in 14 trading session.Such big falls are also accustomed by fast and furious short covering rallies, Bulls need to close above 7767 for move towards 7820/7885/7995 and bears any close below 7730 and below green gan arc can see fall till 7630/7539 odd levels. Nifty held on to its gann arc and gave the short covering rally a move of 100 points from the low of 7714. Closing above 7820 will see nifty moving towards 7885/7937 odd levels. Support at 7734/7714 range below that new low probability will increase. Bank Nifty near gann line,EOD Analysis

- Nifty November Future Open Interest Volume is at 1.71 core with liquidation of 3.9 Lakh with increase in CoC suggesting short position were closed today.NF closed below the Rollover cost @8294

- Total Future & Option trading volume was at 2.19 Lakh core with total contract traded at 1.57 lakh , PCR @0.79. Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8200 CE OI at 71.1 lakh , wall of resistance @ 8200 .7800/8200 CE added 12 lakh in OI so bears adding aggressive position at higher levels.FII bought 9.3 K CE longs and 10.5 K CE were shorted by them.Retail bought 5.1 K CE contracts and 22.5 K CE were shorted were by them.

- 7700 PE OI@ 58.6 lakhs strong base @ 7700. 7500/7900 PE liquidated 0.03 lakh so bulls finally giving up and no major addition was seen after 100 points recovery from lows .FII bought 26.1 K PE longs and 1.8 K shorted PE were covered by them .Retail bought 5.9 K PE contracts and 10.7 K PE were shorted by them.FII going with bearish bias till now.

- FII’s sold 1051 cores in Equity and DII’s bought 661 cores in cash segment.INR closed at 65.83.

- Nifty Futures Trend Deciding level is 7797 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7971 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7835 Tgt 7858,7885 and 7912 (Nifty Spot Levels)

Sell below 7780 Tgt 7760,7735 and 7710 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh