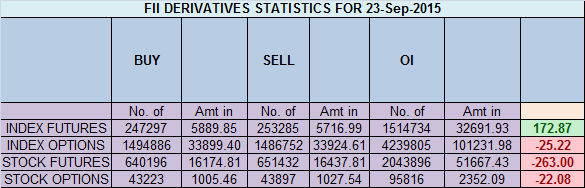

- FII’s sold 5.9 K contract of Index Future worth 172 cores ,19.4 K Long contract were added by FII’s and 14.5 K short contracts were added of by FII’s. Net Open Interest increased by 26.2 K contract, so today’s rise in market was used by FII’s to enter both long and huge shorts in Index futures, as Rollover have started happening. Important Message for Traders Holding Dec 2015 Options Contracts

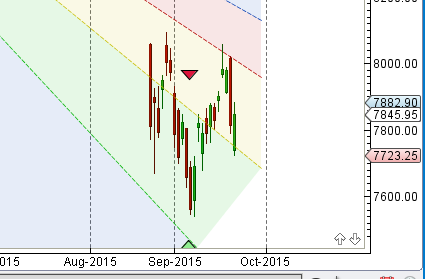

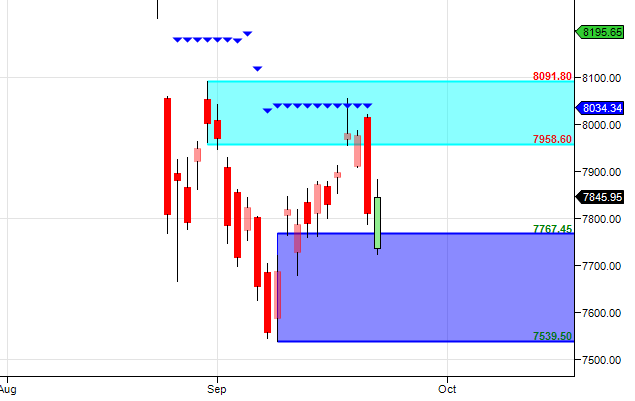

- As discussed in previous analysis 7767 is the demand zone if held we can see bounceback till 7870/7900 if not we are heading towards 7539 and 7422 Nifty made low of 7723 in gap down open bounced back above 7787 till 7882, Nifty has been oscillating in Fibo Fans as shown in below chart break of today low @7723 can see nifty entering in new zone can reach towards 7539 /7400. Tomorrow is expiry so we need to watch 7930/7958 on upside and 7820/7751 on downside.

- Nifty September Future Open Interest Volume is at 1.53 core with liquidation of 24 Lakh with increase in CoC suggesting long position have booked profit today. Rollover stand at just 47.4 and rollover cost @7950 as of today.

- Total Future & Option trading volume was at 4.83 Lakh core with total contract traded at 7.1 lakh . PCR @1.03 Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8000 CE OI at 42.8 lakh , wall of resistance @ 8000 .7700/8200 CE liquidated 12 lakh in OI so bears ran for cover in 7800 CE. FII bought 19.4 K CE longs and 26.2 K CE were shorted by them.Retail sold 46.7 K CE contracts.

- 7600 PE OI@ 42 lakhs strong base @ 7600. 7500/7600 PE added 11 lakh so bulls making base strong at lower level. FII bought 14.5 K PE longs .Retail bought 91.4 K PE contracts and 68.5 K PE were shorted by them.

- FII’s sold 1330 cores in Equity and DII’s bought 891 cores in cash segment.INR closed at 65.99 trading at 2 year low.1997 Asian Currency Crisis happening again

- Nifty Futures Trend Deciding level is 7807 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7847 and BNF Trend Deciding Level 17076 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 16816 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 7830 Tgt 7850,7877 and 7900 (Nifty Spot Levels)

Sell below 7780 Tgt 7750,7725 and 7700 (Nifty Spot Levels)

Upper End of Expiry:7930

Lower End of Expiry:7760

Click Here to Like Facebook Page get Real time updates

dear sir nifty intraday week below…?

bramesh ji , what about … longs and shorts by FII’s.. they are exact same values as yesterdays … plz check and reply .

regards

kamaldeep singh

Thanks Kamaldeepji its corrected..

are buy and sell level correct. showing yesterdays levels

they are correct