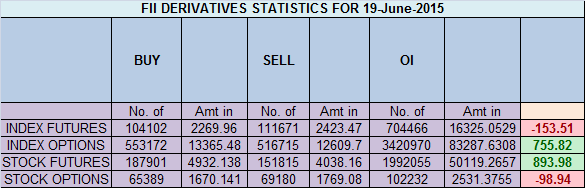

- FII’s sold 7.5 K contract of Index Future worth 153 cores ,12.4 K Long contract were squared off by FII’s and 4.8 K short contracts were squared off by FII’s. Net Open Interest decreased by 17.3 K contract, so todays rise was used by FII’s to exit longs and shorts in index futures. Important Pillars of Trading :Self Control and Discipline

- This is what we have discussed in last few analysis We have been advocating the range of 7930-7950 being the demand zone for Nifty from 11 June Nifty made the following lows 7958,7940,7944 and 7946 also we have discussed in Weekly Analysis from 14 June time cycle has changed to neutral to Bullish, market obliged with 5 green close from past 5 days. Also Nifty has completed 2 crucial harmonic pattern ABCD and BAT pattern both are bullish if 7930 is held. Traders who bought should have been rewarded, As per gann angles above 8100 we can move towards 8189/8211 odd levels. and pyrapoint, also suggests 8195 on cards. All Target done.Gann Angle 8×1 comes @8224, Trendline resistance also comes at 8239/8254 and Gunner also suggest green arc will be short term target. Nifty closed exactly at 8224 8×1 angle, now Resistance zone @8254-8261 which is 61.8%retracement also needs to be closely watched on Monday. Support in range of 8180-8150.

- Nifty June Future Open Interest Volume is at 1.50 core with liquidation of 8.5 Lakh, with increase in CoC suggesting shorts have exited out of system.

- Total Future & Option trading volume was at 2.68 core with total contract traded at 4.5 lakh. PCR @1.26 huge jump in PCR.

- 8500 CE OI at 48.2 lakh , wall of resistance @ 8500 .8000/8500 CE liquidated 18 lakh ,so bears finally gave up and liquidated major positions . FII bought 24.9 K CE longs and 18.3 K shorted CE were covered by them.Retail sold 0.70 lakh CE contracts. So FII’s bought heavily in CE contact and market keep moving higher.

- 8000 PE OI@ 66.3 lakhs so strong base @ 8000. 8100/8500 PE added 30 lakh so bulls added aggressively today so 8100 is coming up to be strong support . FII bought 26 K PE longs and 32.8 K PE were shorted by them.Retail bought 1.36 lakh PE contracts.So FII’s long in CE and Retailers long in PE, so again its smart money which wins retailers holding short and market rising.

- FII’s sold 106 cores in Equity and DII’s bought 447 cores in cash segment.INR closed at 63.6

- Nifty Futures Trend Deciding level is 8151 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8220 and BNF Trend Deciding Level 17794 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17795 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8252 Tgt 8278,8307 and 8337 (Nifty Spot Levels)

Sell below 8220 Tgt 8197,8170 and 8142 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

thanks again for your detailed analysis. please give view on IT stock technical. Long corrections in Infosys. any chance of recovery

Sir, kindly check intraday TC. Is it 8151.

Last week we were in bullish from neutral. How about this week ? Are we in Bull or bear or Neutral ???

Dear Bramesh falling trendline value comes around 8330 – 8350 zone…till it is far away from 100 points….

No it’s not. It’s around 8250-8280. Market can touch these levels and fall sharply intraday itself.

Sir whether i can sell vivimaid labs with stoploss rs 207 give chart for the script