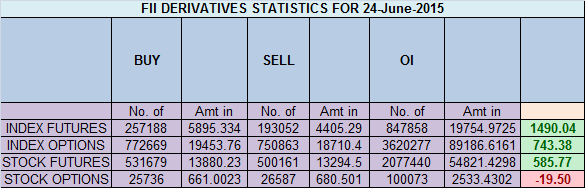

- FII’s bought 64.1 K contract of Index Future worth 1490 cores ,113 K Long contract were added off by FII’s and 49 K short contracts were added by FII’s. Net Open Interest increased by 162 K contract, so todays last hour expected fall was used by FII’s to enter majority longs and partial shorts in index futures. Do You Trade The Market or Your Emotions ?

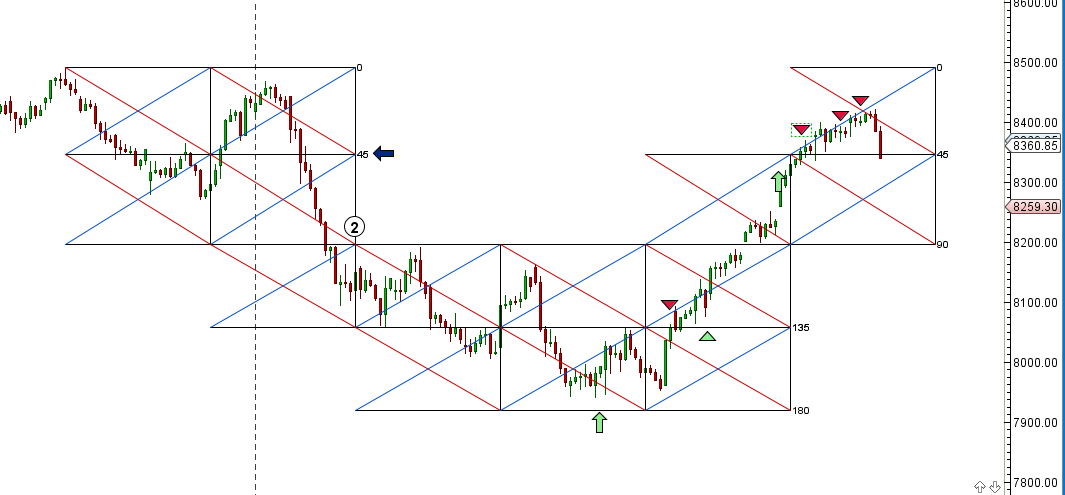

- This is what we discussed in yesterday analysis Nifty finally formed DOJI at the upper end of AF as shown in below chart.So if 8393 not crossed which is 50% Fibo retracement levels we can see some pullback of 8300/8270 in nifty. Gunner also show we are heading to grey line and green arc so caution advised on longs.High made today is at 3×1 gann angles as shown in hourly charts. So Finally we had a pullback of 83 points as Market reacted sharply in last 30 mins, Many traders were saying its Greece news which has made market fall but as i always says everything is seen on chart and follow chart and level not news. We were caution on longs from yesterday as Nifty was stalling near Gann 3×1 Angle, Pyrapoint was also showing pullback on cards as the blue line was acting strong resistance as shown below. Gunner also reacted from green arc. Nifty even after the pullback formation of Higher High and Higher low stays as 8334 low was not broken yesterday. So if 8326 range not broken today we can close at the high point of the expiry.

- Nifty June Future Open Interest Volume is at 1.13 core with liquidation of 4.9 Lakh, with increase in CoC suggesting shorts have entered system today.NF Rollover is at 43% with average rate @ 8346.

- Total Future & Option trading volume was at 4.19 core with total contract traded at 4.4 lakh. PCR @1.22, good jump in PCR.

- 8500 CE OI at 47.2 lakh , wall of resistance @ 8500 .8000/8500 CE liquidated 13 lakh ,so bears finally gave up and liquidated major positions . FII bought 45 K CE longs and 7.2 K shorted CE were covered by them.Retail sold 11 K CE contracts. So FII’s bought heavily in CE contact and market keep moving higher.

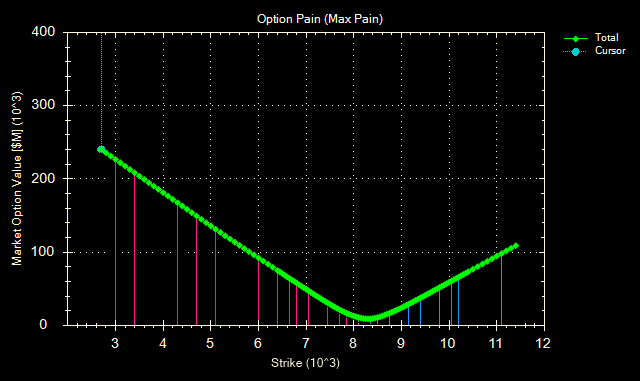

- 8200 PE OI@ 51 lakhs so strong base @ 8200. 8100/8500 PE liquidated 14.7 lakh so weak bulls@8400 gave up in last hour and exited in panic . FII bought 6.8 K PE longs and 37.5 K PE were shorted by them.Retail exited 57.8K PE contracts.So FII’s long in CE and Retailers long in PE, so again its smart money which wins retailers holding short and market rising. Option Pain of NIFTY comes @8300 as seen in below chart.

- FII’s bought 92.5 cores in Equity and DII’s bought 13.5 cores in cash segment.INR closed at 63.6

- Nifty Futures Trend Deciding level is 8384 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8182 and BNF Trend Deciding Level 18394 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 17877 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8375 Tgt 8400,8421 and 8456 (Nifty Spot Levels)

Sell below 8325 Tgt 8300,8270 and 8250 (Nifty Spot Levels)

Upper End of Expiry:8430

Lower End of Expiry:8291

Click Here to Like Facebook Page get Real time updates

this people saying greece news only it has fallen

first stop seeing news channels

Today as per past analysis of settements Nifty first come to near 8298 and plz plz go long there for expiry near 8400.For going down Condition is Todays High should not be 8381.