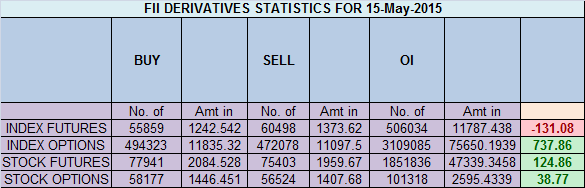

- FII’s sold 4.6 K contract of Index Future worth 131 cores,6.2 K Long contract were added by FII’s and 10.8 K short contracts were added by FII’s. Net Open Interest increased by 17.1 K contract so today’s rise was used by FII’s to add shorts and partial longs in Index Future. How To Identify Market Tops and Bottom

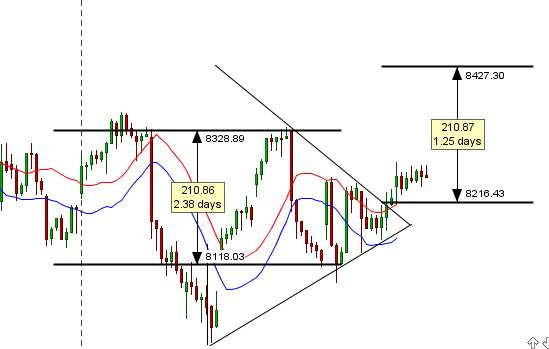

- Nifty from past 6 session has become very very volatile, Again matter of mins fell down 80 points recovered sharply and again closed near the highest point of day forming hammer pattern.Triangle pattern in hourly pattern as shown in below chart, has broken on upside, we need to see follow up move on Monday. Gunner is also entering new quadrant and pyrapoint analysis suggests Nifty is ready for an explosive move.

- Nifty May Future Open Interest Volume is at 1.40 core with liquidation of 0.71 lakhs with cost of carry going negative suggesting long position got closed. OI is lowest in last 3 months, such low OI generally suggests trending move is round the corner.

- Total Future & Option trading volume was at 1.87 core with total contract traded at 3.5 lakh. PCR @1 .

- 8500 CE OI at 52.6 lakh , wall of resistance @ 8500 .8100/8400 CE saw negligible addition ,so bears were quiet but still holding 93 lakh open position. FII bought 26.2 K CE longs and 1.4 K CE were shorted by them.

- 8000 PE OI@ 50.8 lakhs so strong base @ 8000. 8100/8400 PE added 6.4 lakh so bulls are gaining ground and holding 24 lakh open position. FII sold 7.6 K PE longs and 5.1 K shorted PE were covered by them. Retailers have bought 69.8 K PE contracts in today’s session.

- FII’s sold 38 cores in Equity and DII’s bought 564 cores in cash segment.INR closed at 63.63

- Nifty Futures Trend Deciding level is 8259(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8232 and BNF Trend Deciding Level 18178 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18090 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8290 Tgt 8318,8333 and 8357 (Nifty Spot Levels)

Sell below 8250 Tgt 8223,8200 and 8184(Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Good trading is based on four pillars.Gann gunner pyrapoint and Brameshji.Kind of you for holding hand and pointing the way to Sunrise.

Good Wishes.

Thanks !!

Hi Bramesh,

FII sold 7.6 k PE long means …? Can u help me in understanding that….

They shorted PE.

DearSir

would like to have a word with u re trend deciding levels and how to trade

Please read this http://www.brameshtechanalysis.com/2013/09/nifty-futures-positional-strategy/