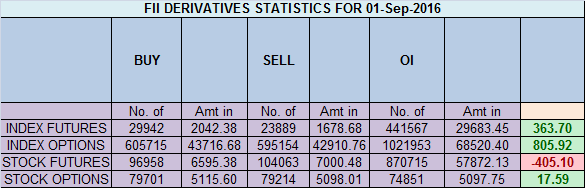

- FII’s bought 6 K contract of Index Future worth 364 cores ,11.6 K Long contract were added by FII’s and 5.6 K short contracts were added by FII’s. Net Open Interest increased by 17.2 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. Not able to pull the trigger in Trading

- As discussed in Yesterday Analysis Bulls above 8723 can see move till 8851/8900. Nifty made high of 8813 before seeing profit booking. As seen in the below gann angle chart Bulls needs to hold 8723-8751 range for a move towards 8951-8976 zone. Bears will get active below 8650 only. Bank Nifty Gann Angles Analysis

- Nifty Sep Future Open Interest Volume is at 3.36 core highest in last 6 years with addition of 4.4 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @8686, closed above it.

- Total Future & Option trading volume was at 4.83 Lakh core with total contract traded at 1.09 lakh , PCR @1.02 , Trader’s Resolutions for the New Financial Year 2016-17

- 9000 CE is having Highest OI at 58.3 lakh, resistance at 9000 .8500/9000 CE added 4.1 lakh so resistance formation in 8850-8900 zone .FII bought 6.5 K CE longs and 3.6 K CE were shorted by them .Retail sold 7.4 K CE contracts and 12.7 K shorted CE were covered by them.

- 8500 PE OI@65.5 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 3.2 Lakh in OI so bulls making strong base near 8600-8650 zone .FII bought 20.9 K PE longs and 13.5 K PE were shorted by them .Retail sold 87.8 K PE contracts and 46.5 K shorted PE were covered by them.

- FII’s sold 301 cores in Equity and DII’s bought 308 cores in cash segment.INR closed at 66.96

- Nifty Futures Trend Deciding level is 8824 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8722 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8785 Tgt 8805,8835 and 8860 (Nifty Spot Levels)

Sell below 8750 Tgt 8725,8700 and 8670 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh