Last Week we gave Chopad Levels of 7546 , Nifty gave Short entry on Monday and got Stopped out on Monday and again gave Long Entry on Monday which did all 3 target by Wednesday. Last Week close was at a very crucial gann level of 7850 where we have price and time sqaure so if 7850 is held we can see a move towards 8100/8250 in coming weeks. Lets analyses how to trade nifty in coming week as we have only 4 trading days as 19 April is trading Holidays.

Nifty Hourly Chart

Nifty hourly broke 135 degree on 11 April after giving whipsaw and than saw a quick move towards 45 degree as shown above, Holding 7850 on Upside will bee move towards 7972/8096 where 1 rotation of price is completed.

Nifty Harmonic

As discussed in last week Now we are forming a SHARK Patter as shown above Holding 7545 we can see move towards 7649/7696.

Both target done Now Holding 7850 we can see move till 7972/8096 as per forming shark pattern.

Nifty Gann Angles

Nifty showed an important breakout this week as first time after 04 March Nifty has broken an important gann angle as shown above,Now for coming few weeks 7777 needs to be watched. If held on it nifty can move towards 8100/8250 as per gann price and time analysis.

Nifty Supply and Demand

As discussed in last analysis Nifty closed below 7600 hence bullish move towards 7859/7900 has been negated. Now Bulls needs to close above 7584 for move towards 7730/777. Close below 7500 will see move towards 7405.

Nifty made low of 7516 not going below 7500 and once it went above 7584 fired up and will do 7900 by Monday. Now we need to see close above 7921 on Weekly basis for next move till 8336.

Nifty Gann Date

Nifty As per time analysis 18/21 April is Gann Turn date , except a impulsive around this dates. Last week we gave 11 April Nifty formed short term bottom on 11 April

Nifty Gaps

For Nifty traders who follow gap trading there are 6 trade gaps in the range of 7000-9000, rest all gaps were filled in the last week fall.

- 7109-7090

- 7222-7308

- 7368-7406

- 7387-7275

- 7298-7271

- 7708-7777

- 8937-8891

- 8251-8241

- 8232-8209

- 8116-8130

Fibonacci technique

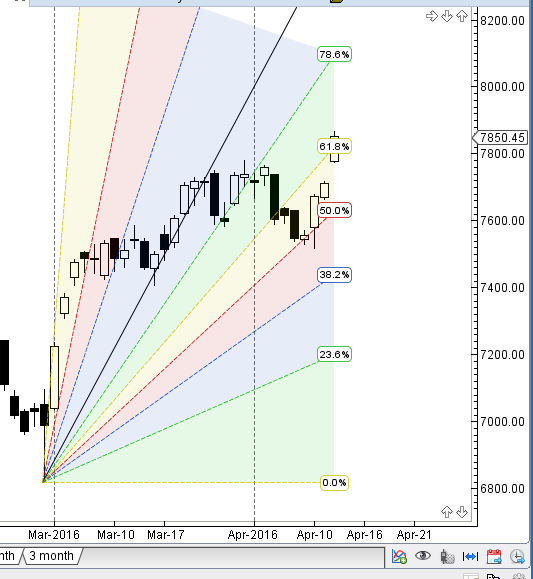

Fibonacci Fan

Holding 61.8% as shown above can see move towards 78.6% which is near 8090-8100 range.

Nifty Weekly Chart

It was positive week, with the Nifty up by 295 points closing @7850 forming a bullish engulfing pattern , close above the upper line of AF first time after 9119 which is a big positive based on technical, Now need to see if we close above 7850 for next 2 weeks if we do than we are heading towards 8100/8250.

Trading Monthly charts

Monthly chart support at 50% and bounced from that.

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:7921

Nifty Resistance :7972,8041,8116

Nifty Support :7850,7777,7720

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh