- FII sold 3.1 K contract of Index Future worth 114 cores, Net OI has increased by 7.1 K contract, 2 K Long contract were added by FII and 5.1 K Shorts were added by FII. Net FII Long Short ratio at 1.23, So FII used rise to enter longs and enter shorts.

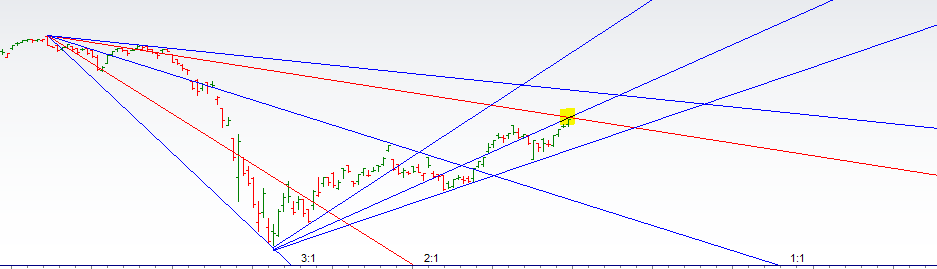

- As discussed in last analysis We opened with gap up and did all target on upside, We are near an important gann angle resistance as shown in below chart, Bulls need a close above 10378 for a move back to 10429/10480. Bears will get active below 10250 for a move back to 10190/10140.Low made was 10301 so bears unable to break 10250 and once above 10378 did 10480. Now Bulls need to close above 10505 for a move back to 10556/10610/10666. Bears will get active below 10400 for a move back to 10351/10300.We are near Important gann angle resistance as shown in below chart.

- Intraday time for reversal can be at 10:01/10:43/12:20/1:23/2:15 How to Find and Trade Intraday Reversal Times

- Total Future & Option trading volume at 13.82 Lakh core with total contract traded at 1.93 lakh , PCR @0.84

- Nifty July Future Open Interest Volume is at 47 Lakh with addition of 16.9 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @9164 closed above it.

- 10500 CE is having Highest OI at 24 Lakh, resistance at 10500 followed by 10600.10200-10600 CE added 22 Lakh in OI so bears added in range of 10400-10600.FII bought 3 K CE and 4.7 K shorted CE were covered by them. Retailers sold 22 K CE and 4 K shorted CE were covered by them.

- 10300 PE OI@28 Lakhs having the highest OI strong support at 10300 followed by 10200. 10100-10300 PE added 33 Lakh in OI so bulls added position in range 10200-10300.FII bought 953 PE and 13.4 K PE were shorted by them. Retailers bought 99 K PE and 52 K PE were shorted by them.

- FII’s bought 168 cores and DII’s bought 454 cores in cash segment.INR closed at 75.55

- Nifty Futures Trend Deciding level is 10383 For Intraday Traders). NF Trend Changer Level (Positional Traders) 9968 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy Above 10484 Tgt 10505,10533 and 10558 (Nifty Spot Levels)

Sell Below 10445 Tgt 10419,10385 and 10360(opens in a ne (Nifty Spot Levels)

- Follow on Twitter:https://twitter.com/brahmesh

- Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

- Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ

- Trading Course Details: http://www.brameshtechanalysis.com/online-technical-analysis-course/