- FII bought 3.6 K contract of Index Future worth 249 cores, Net OI has decreased by 108 contract, 1.8 K Long contract were liquidated by FII and 1.7 K short were added by FII. Net FII Long Short ratio at 0.81, So FII used rise to exit longs and enter shorts.

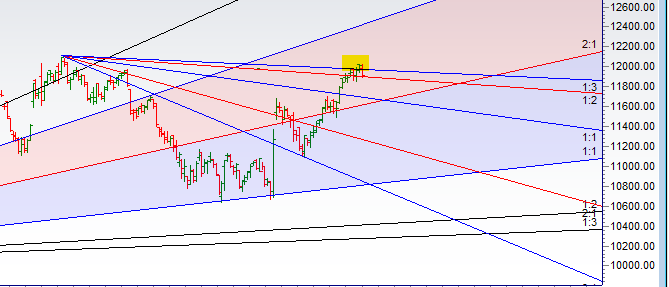

- As discussed in last analysis Low made was 11946 and we closed above 12000 so rally can extend towards 12055/12110/12166. Bears will get active below 11940 for a move back to 11890/11821. High made was 12034 so missed our target of 12055 but once below 11940 did our 1 target 11890. Bulls now need to move above 11960 for a move to continue towards 12013/12068/12110. Bears will get active below 11870 for a move back to 11815/11761.11 Very Important time cycle date.

- Important intraday time for reversal can be at 9:27/10:49/11:49/12:24/1:57 How to Find and Trade Intraday Reversal Times

- Total Future & Option trading volume at 9.67 Lakh core with total contract traded at 1.59lakh , PCR @0.84

- Nifty Nov Future Open Interest Volume is at 1.57 Lakh core with liquidation of 3.8 Lakh with decrease in cost of carry suggesting short position were added today, NF Rollover cost @11814 closed above it.

- 12000 CE is having Highest OI at 26 Lakh, resistance at 12000 followed by 12100 .11500-12000 CE added 36 Lakh in OI so bears added position in range of 12000-12200.FII bought 9.9 K CE and 2.7 K CE were shorted by them. Retailers bought 110 K CE and 94.9 K CE were shorted by them.

- 11800 PE OI@11.5 Lakhs having the highest OI strong support at 11900 followed by 11800 . 11500-12000 PE added 5 Lakh in OI so bulls added position in range 11800-11900.FII bought 21.2 K PE and 9.8 K PE were shorted by them. Retailers bought 85.5 K PE and 83.7 K PE were shorted by them.

- FII’s bought 932 cores and DII’s sold 584 cores in cash segment.INR closed at 71.37

- Nifty Futures Trend Deciding level is 11992 For Intraday Traders). NF Trend Changer Level (Positional Traders) 11968 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy Above 11945 Tgt 11970,12000 and 12030 (Nifty Spot Levels)

Sell Below 11885 Tgt 11860,11830 and 11800 (Nifty Spot Levels)

Follow on Twitter:https://twitter.com/brahmesh

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Youtube Channel: https://www.youtube.com/channel/UCxTIpotKybyOQIDsS3eEqhQ

Fantastic prediction 0927 was classic reversal. Great Brahmesh Ji

thanks Ganeshji..