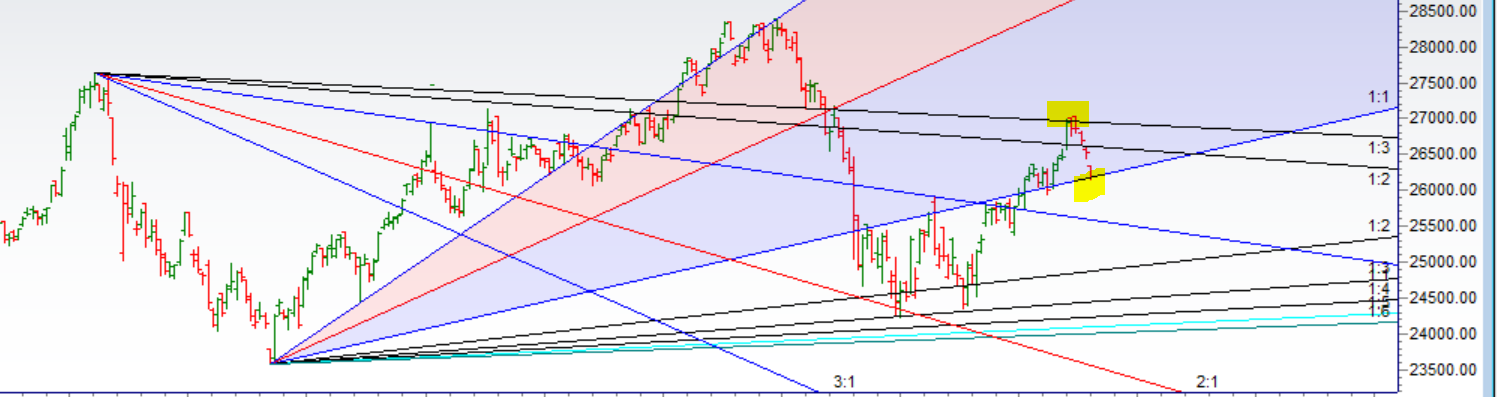

- As Discussed in Last Analysis Bears were able to achieve the 2 target on downside@26500 and now heading towards 26314 where strong support lies. Again time cycle helped in trading as Bank Nifty made high on 27032 on 03 Dec and we are falling from that date. Bulls will get active above 26656 for a move back to 26784/26928/27000. Bank Nifty did all our target on downside and took support at gann angle as shown below, Now Bulls need to move above 26250 for a move back to 26323/26496. Bearish below 26100 for a move back to 26000/25920. Exit Polls result will be announced tomorrow evening so better not to carry position overnight as we are going to see lot of volatility in next 2 trading session Important intraday time for reversal can be at 10:37/12:32/2:48. Stock Market and State Elections Part -II

- Bank Nifty Dec Future Open Interest Volume is at 14.9 lakh with liquidation of 1.6 Lakh, with decrease in Cost of Carry suggesting short positions were closed today. Bank nifty Rollover cost @26532 closed below it.

- 27000 CE is having highest OI @4.3 Lakh resistance at 27000 followed 27300. 26000-28000 CE added 2.1 Lakh in OI so bears making resistance in the zone of 27000-27500.

- 26000 PE is having highest OI @9.5 Lakh, strong support at 26000 followed by 25800.26000-28000 PE liquidated 1 Lakh OI so bulls making strong support in the range of 26000-26100.

- Bank Nifty Futures Trend Deciding level is 26326 For Intraday Traders). BNF Trend Changer Level (Positional Traders) 26746 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 26250 Tgt 26323,26410 and 26525 (Bank Nifty Spot Levels)

Sell below 26150 Tgt 26070,26000 and 25920 (Bank Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh