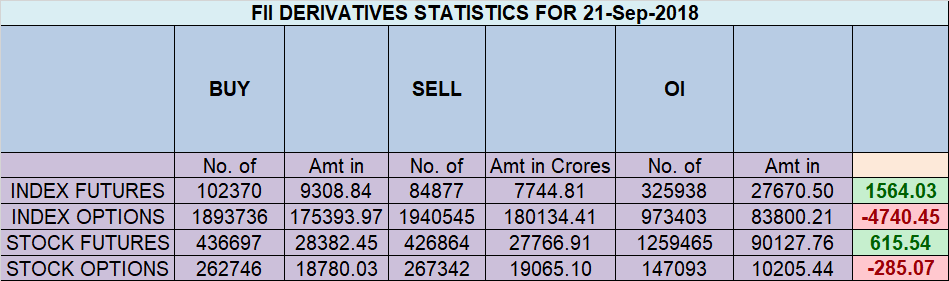

- FII’s bought 17.4 K contract of Index Future worth 1564 cores ,12.7 K Long contract were added by FII’s and 4.7 K Short contracts were covered by FII’s. Net Open Interest increased by 8 K contract, so fall in market was used by FII’s to enter long and exit short in Index futures. FII’s Long to Short Ratio at 0.91. What Caused Huge sell-off and panic in the Stock Market yesterday?

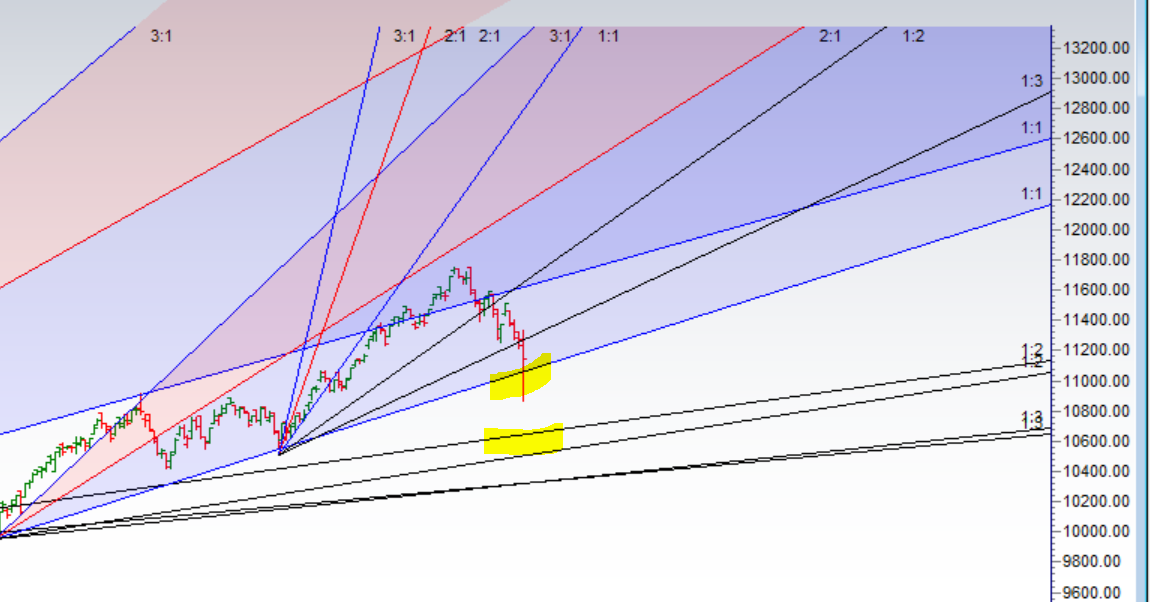

- As Discussed in Last Analysis Nifty formed a new swing low at 11210 below 11366 we have told in last analysis, Now risk to reward ratio towards short is less as we will be entering an important support zone of 11160-11170, holding the same we can see the much anticipated relief rally, towards 11330/11400. We have important time cycle date today effect should be seen tomorrow. We saw the effect of time cycle as soon as the support of 11160-11170 broken we saw a water fall decline towards 10870, Nifty had a black swan event, we were prepared for it and price broke the gann angle on Wednesday.Now Bounce like we saw on Friday are generally get sold into and price revisit the low price hit in next few days. Till we are trading below 11300 bears have upper hand. Bearish below 11080 for a move back to 11000/10890/10800/10720. Bullish above 11170 for a small relief rally towards 11230/11300/11350. Important intraday time for reversal can be at 10:23/12:15/2:50. Bank Nifty Bears make a Killing on Black Swan Event

- Nifty Sep Future Open Interest Volume is at 2.33 core with liquidation of 22.1 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @11747 and Rollover %@ 67

- 11400 CE is having Highest OI at 30 Lakh, resistance at 11300 followed by 11400 .10800-13800 CE added 21 lakh in OI so bears added position in range of 11300-11400 CE. FII sold 18.1 K CE and 16.6 K CE were shorted by them. Retail bought 39.5 K CE and 5.6 K shorted CE were covered by them.

- 11000 PE OI@38.3Lakhs having the highest OI strong support at 11000 followed by 10900 . 10800-11600 PE liquidated 34 Lakh in OI so bulls covered position in range 11200-11400 PE. FII sold 3.8 K PE and 8.1 K PE were shorted by them. Retail sold 6.4 K PE and 16.6 K shorted PE were covered by them.

- Total Future & Option trading volume at1 13.33 Lakh core with total contract traded at 2.84 lakh , PCR @0.93

- FII’s bought 760 cores and DII’s bought 497 cores in cash segment.INR closed at 72.20, Started correcting from 73 level as discussed in Rupee Analysis. Indian Rupee nearing a Short term top

- Nifty Futures Trend Deciding level is 11209 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 11502. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 11160 Tgt 11183,11210 and 11250 (Nifty Spot Levels)

Sell below 11100 Tgt 11070,11040 and 11000 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh