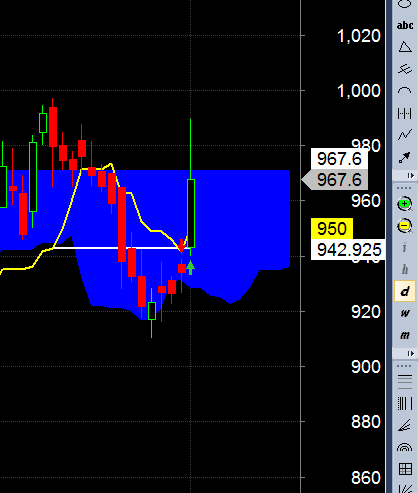

Exide Industries

Positional Traders can use the below mentioned levels

Close above 212 Target 220/225

Intraday Traders can use the below mentioned levels

Buy above 212 Tgt 214,217 and 220 SL 210.5

Sell below 210 Tgt 208.5,205.5 and 203 SL 211.5

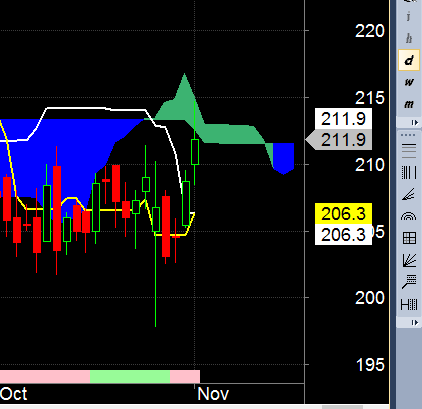

Hind Petro

Positional Traders can use the below mentioned levels

Close below 440 Target 432/420

Intraday Traders can use the below mentioned levels

Buy above 446 Tgt 449,455 and 459 SL 443

Sell below 442 Tgt 439.5,435 and 430 SL 445

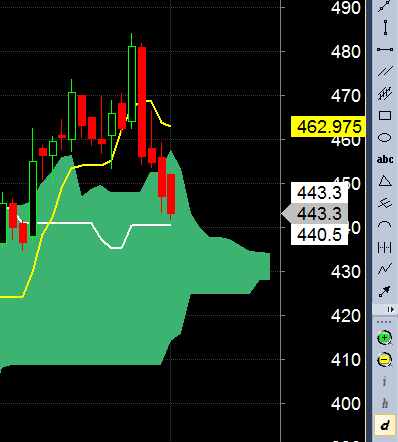

Godrej CP

Positional Traders can use the below mentioned levels

Close above 971 Target 1000/1030

Intraday Traders can use the below mentioned levels

Buy above 971 Tgt 977,984 and 990 SL 967

Sell below 964 Tgt 957,950 and 942 SL 968

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for October Month, Intraday Profit of 3.58 Lakh and Positional Profit of 10.37 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if Trading Systems are followed with discipline. Performance “Will differ” from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Bramesh

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

sir,I have a doubt.You discuss the analysis based on different methods.(For eg Ichimoku,Harmonics,supply demand etc) When you analyse a stock if 2 different methods give entirely opposite ideas (Long & Short).Which one to follow. Kindly i request you to clarify.

We follow the Golden Rule.. When in doubt stay out..

Bramesh ji,

Small request for u.

Can you update the positional trading performance sheet regularly.

I would be of immense help for us in following the levels posted.

As I do not run any advisory services, I am not bound to update it. But still as and when i get time i try to update it..