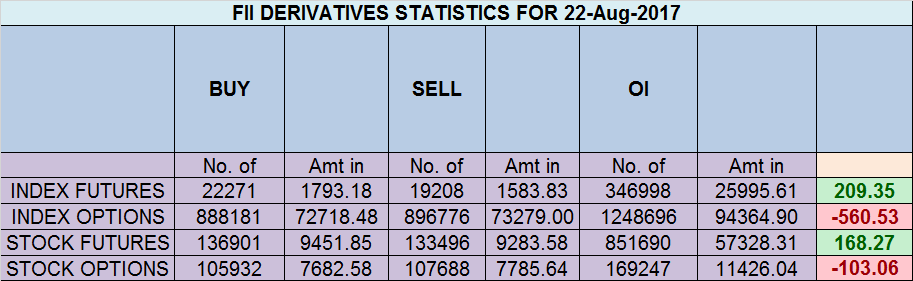

- FII’s bought 3 K contract of Index Future worth 209 cores ,2.4 K Long contract were added by FII’s and 569 Short contracts were liquidated by FII’s. Net Open Interest increased by 1.9 K contract, so rise in market was used by FII’s to enter long and exit short in Index futures. FII’s Long to Short Ratio at 1.14,For the August Series FII have net added shorts 130 K Contract till we do not close above 9910 all rallies will get sold into. Day-Traders Lose Big, Still Live in Denial

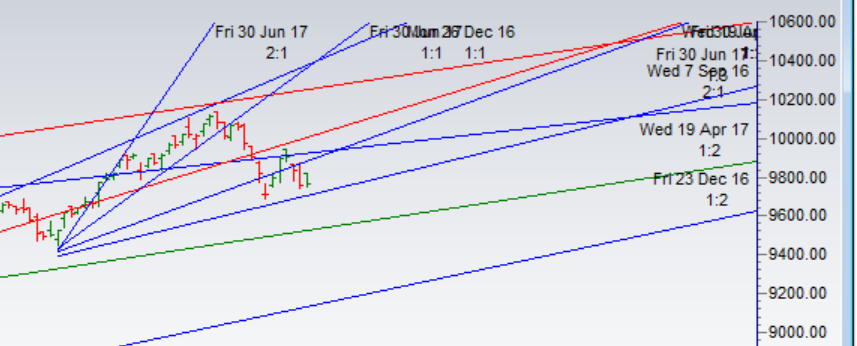

- As discussed in last analysis Today was saw the effect of 20 Aug Time cycle date, now we have 22-24 Aug dates to be seen , as discussed in Facebook post . Bullish only above 9910 only. Bullish above 9830 for a move towards 9884/9920 towards higher side of gann angle. Bearish below 9740 break of lower end of gann angle for a move towards 9685/9610. Bank Nifty continue to close below 24000,EOD Analysis

- Nifty August Future Open Interest Volume is at 2.51 core with liquidation of 4.7 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @10036 Closed below it.

- Total Future & Option trading volume at 6.28 Lakh core with total contract traded at 1.39 lakh , PCR @0.95

- 10000 CE is having Highest OI at 58.8 lakh, resistance at 9900 followed by 10000 .9500-10000 CE added 4.7 Lakh in OI so bears added major position in range of 9700 CE. FII bought 1.3 K CE longs and 6.6 K CE were shorted by them.Retail bought 23.6 K CE contracts and 15.3 K CE were shorted by them.

- 9800 PE OI@51.1 lakhs having the highest OI strong support at 9800 followed by 9700. 9400-10000 PE added 14 Lakh in OI so bulls covered position in 9400-9800 PE. FII bought 3.9 K PE and 3 K PE were shorted by them. Retail sold 3.3 K PE and 18.6 K PE were shorted by them

- FII’s sold 828 cores and DII’s bought 435 cores in cash segment.INR closed at 64.10

- Nifty Futures Trend Deciding level is 9797 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 9961. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 9785 Tgt 9811,9835 and 9870 (Nifty Spot Levels)

Sell below 9750 Tgt 9735,9710 and 9652 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh