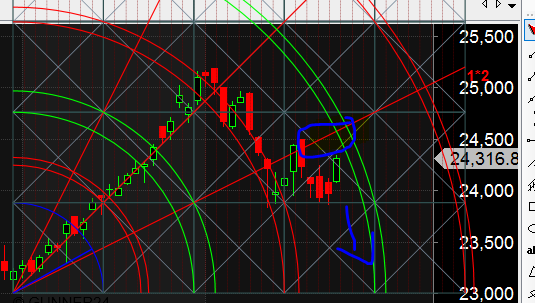

- As discussed in Last Analysis High made today was 24127 above our crucial level of 24100 and also above the gann angle line as shown in below chart and unable to close above 24020 we can continue the correction till 23755/23540. Bullish above 24259 for a move towards only 24480. Bank Nifty opened gap up above 24000,hitting stop loss for traders who were short and once 24260 crossed rallied back to 24350 and holding 24260 can rally towards 24470 which is our vedic number which has given very good trades in this month. Bearish below 24100 for a move towards 23900/23755. 24 Aug is again a time cycle date so trade cautiously. Day-Traders Lose Big, Still Live in Denial

- Bank Nifty Aug Future Open Interest Volume is at 18.2 lakh with liquidation of 3 Lakh, with decrease in Cost of Carry suggesting long positions were closed today. Bank nifty Rollover cost @24665 closed below it.

- 25000 CE is having highest OI @10.5 Lakh resistance at 24500 followed 25000. 23500-26000 CE added 1.1 lakh so bears added position in 24300/24500 CE.

- 24000 PE is having highest OI @11.5 Lakh, strong support at 24000 followed by 23800, Bulls liquidated 4.2 Lakh position in OI in range of 24000-26000 with major liquidation coming in 25000 PE.

- Bank Nifty Futures Trend Deciding level is 24242(For Intraday Traders). BNF Trend Changer Level (Positional Traders) 24577 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 24350 Tgt 24420,24470 and 24530(Bank Nifty Spot Levels)

Sell below 24250 Tgt 24150,24050 and 23950 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Click Here to Join me on Twitter