OOPS trading System can be used for pattern applicable on ALL time frames, 1 minute, 5 minutes, hourly, daily, weekly, monthly or yearly stock market trading systems

History:

Back in 1979 Larry Williams published a description of a short-term trading method that is based on a pattern observed often in markets. The OOPS signal is a gap trading method that fades the direction of the opening gap. It is named thus, according to Williams, because when a broker would report to his clients that they were stopped out, he would call them and say, “Oops, we lost.”

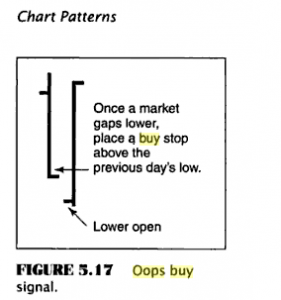

OOPS BUY

a) If you are watching daily charts, the first condition is that there has to be a SUSTAINED downtrend for a few trading sessions.I mean few Red Candles on daily Charts

b)On the last day of downtrend when the Oops buy occurs, there is a gap down, which opens well below the previous day’s low.

c)During the course of trading the stock rises and goes above the previous day’s low, and also the previous day’s close.

The above 3 steps if occurs generates an OOPS buy, with a stop loss of that day’s low.

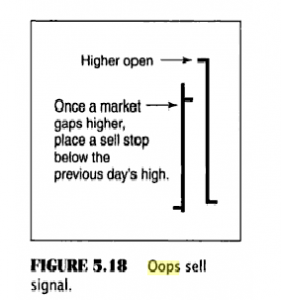

OOPS Sell

a) If you are watching daily charts, the first condition is that there has to be a SUSTAINED Uptrend for a few trading sessions.I mean few white Candles on daily Charts

b)On the last day of uptrend when the Oops sell occurs, there is a gap up opening, which opens well above the previous day’s high.

c)During the course of trading the stock corrects and goes below the previous day’s high, and also the previous day’s close.

The above 3 steps if occurs generates an OOPS sell, with a stop loss at day’s high.

One Practical Example:

As per the Chart Shown above all OOPS Steps are applied and We can see Ashok Leyland correcting to almost 10% from the OOPS SELL Generated.

As per oops system it occurs very less in many trading days. How to focus and find situation if it occurs in different stocks or index.how to filter .did have any solution for that in any exploration. Or scanner ?

Do you have AFL for this

Which time span the Ashok leyland reflects?

Daily

oops pattern is superb and gives top and bottom aand success ratio is also good