Reliance Industries has been barred by Sebi (Securities and Exchange Board of India) on Friday from equity derivatives trading for one year. SEBI has imposed BAN following alleged fraudulent trading in the futures and options (F&O), or derivatives, of RIL’s former listed subsidiary Reliance Petroleum, which has since been merged with the parent firm. Sebi has allowed RIL and other entities to square off or close existing open positions.

The regulator has asked RIL to pay Rs 447 crore along with an annual interest of 12 per cent since November 29, 2007, taking the total disgorgement liability of the company to nearly Rs 1,000 crore. It has been asked to pay the amount within 45 days.SEBI said Reliance has made gain of 551 cores so technically reliance has to pay fine of just 450 cores which is minuscule for company having market cap of 44 Billion USD. This News will be sentimentally negative to stock but long term prospect will not get affected. Lets study the technical parameter of stock how it can react on Monday.

Reliance Gann Chart

As per Gann Angles strong support is at 1250-55 range, If this level get broken we can see fall till 1210 level. 1210 is strong level as per gann analysis, Holding the same we can see rally back to 1268-1280-1300 zone.

Break below 1209 can see move towards 1180/1151.

Reliance Time Cycle is from 27 March-08 April so watch out for trend change around these dates

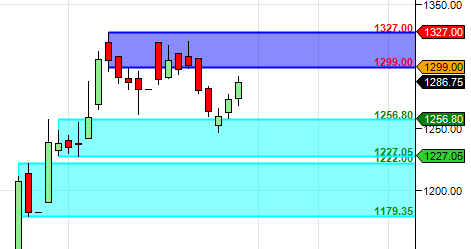

Reliance Supply and Demand

As per Supply Demand Analysis which are also in sync with gann break of 1250 we can see fall towards 1220-1210 zone.

Thank God, it didn’t fell too much as scared by other traders in the opening. Sharing with you about my position in RIL has relieved my pain over the weekend. Thanks my friend Brahmesh ji.