- FII’s bought 4.1 K contract of Index Future worth 352 cores ,6.4 K Long contract were added by FII’s and 2.2 K short contracts were added by FII’s. Net Open Interest increased by 8.6 K contract, so rise in market was used by FII’s to enter long and enter shorts in Index futures. A Person who won’t stand for something will fall for anything..

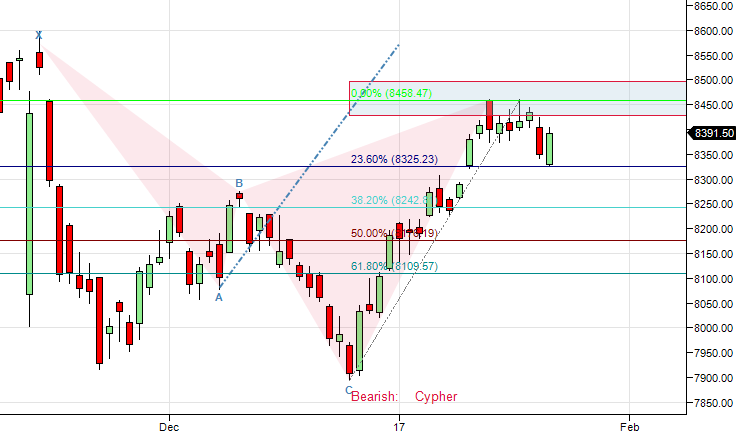

- As discussed in last analysis Nifty did a range breakdown as discussed in last analysis, and closed below 8370 opening the gates towards 8300/8250 range. Bullish only on close above 8460 only. Nifty did low of 8327 doing the target of cypher pattern and bounced back and closed above breakdown level of 8370 but failed to closed above 8410 and also 8432 suggesting bulls are still under pressure, Fresh shorts below 8328 only,for a move till 8290/8250. Bullish only above 8432. Bank Nifty does 18740 and bounces 150 points,EOD Analysis

- Nifty Jan Future Open Interest Volume is at 1.54 core with liquidation of 25 Lakh with increase in cost of carry suggesting short position were added today, NF Rollover cost @8031 closed above it.

- Total Future & Option trading volume at 5.20 Lakh core with total contract traded at 1.55 lakh , PCR @1.03

- 8400 CE is having Highest OI at 49 lakh, resistance at 8400 followed by 8500 .8000/8600 CE liquidated 29.3 Lakh so bears covered position in 8400/8500 CE .FII sold 16.6 K CE longs and 2.3 K CE were shorted by them .Retail bought 19.9 K CE contracts and 6 K CE were shorted by them.

- 8000 PE OI@66.2 lakhs having the highest OI strong support at 8000 followed by 8200. 8000-8600 PE added 10.2 Lakh in OI so bulls added in 8400/8300 PE. FII sold 10.8 K PE longs and 17.5 K shorted PE covered were by them .Retail bought 55.3 K PE contracts and 47.6 K PE were shorted by them.

- FII’s sold 288 cores in Equity and DII bought 520 cores in cash segment.INR closed at 68.21

- Nifty Futures Trend Deciding level is 8386 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8312. How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8405 Tgt 8421,8450 and 8498 (Nifty Spot Levels)

Sell below 8370 Tgt 8345,8320 and 8300 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh