- As discussed in Last analysis Bank Nifty made exact low of 19735 near our demand zone of 19738 and bounced back, Now bulls need a close above 19928 to be back in the game for target of 20155, Any close above 20155 will take us towards 20576/20600 levels. Bears below 19700 can push bank nifty towards 19451. Low made today was 19732 again held on to demand zone as we have been discussing but unable to close above 19928. Bulls need a close above 19928 for a move towards 20155/20380. Bears will get active only below 19700 for target of 19451. Avoiding Impulsive Trading

- Bank Nifty Sep Future Open Interest Volume is at 22.9 lakh with liquidation of 0.22 lakh, with rise in Cost of Carry suggesting short positions were added today. Bank nifty closed above Rollover cost ,rallied 1000 points before this correction. Do you know your Risk of Ruin in trading ?

- 20000 CE is having highest OI @7.2 resistance at 20000. 18500-20500 CE saw 2.8 lakh addition in OI so bears are adding in 20000 CE.

- 19000 PE is having highest OI @10.6 Lakh, strong support at 19000 followed by 19500, Bulls added 0.70 Lakh in OI in 18500-20500 PE so bulls still holding on to support in zone of 19800-19900 zone.

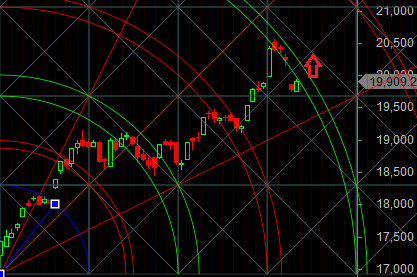

- Bank Nifty Futures Trend Deciding level is 19965 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 19909 .How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 20000 Tgt 20085,20210 and 20350(Bank Nifty Spot Levels)

Sell below 19850 Tgt 19780,19700 and 19600 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Click Here to Join me on Twitter