Amar Raja

Positional Traders can use the below mentioned levels

Holding 932 Tgt 966/987

Intraday Traders can use the below mentioned levels

Buy above 942 Tgt 953,960 and 970.5 SL 937

Sell below 932.8 Tgt 925.8,911 and 898 SL 937

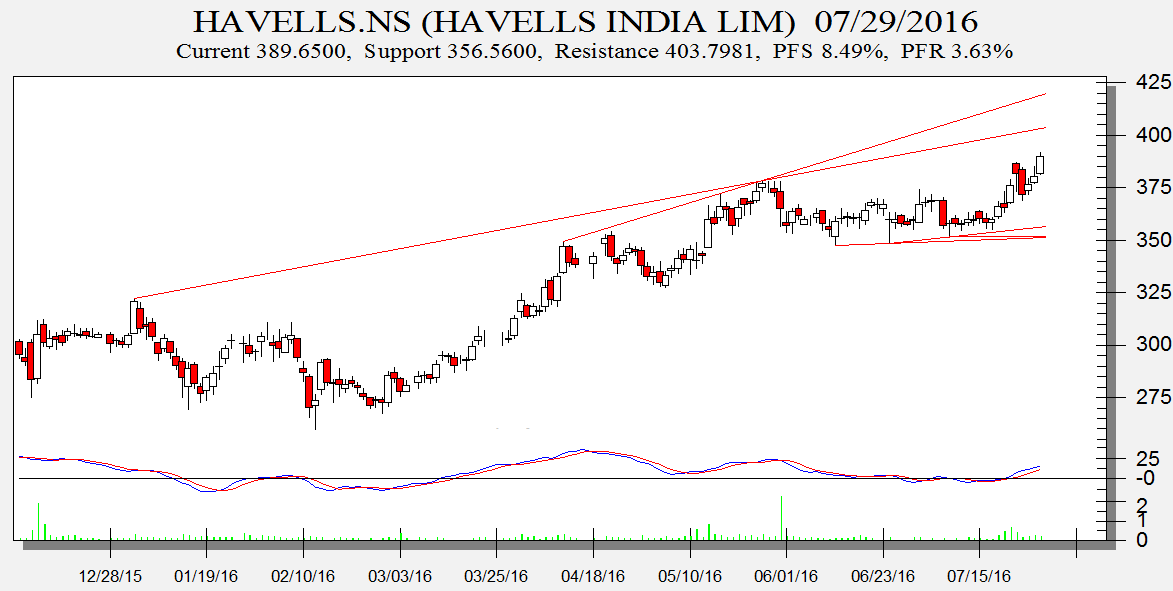

Havells

Positional Traders can use the below mentioned levels

Close above 390 Tgt 398/411

Intraday Traders can use the below mentioned levels

Buy above 390 Tgt 393,396.5 and 398.5 SL 388.5

Sell below 386.8 Tgt 383.8,380.5 and 376 SL 388

Britania

Positional Traders can use the below mentioned levels

Close above 2961 Tgt 3194

Intraday Traders can use the below mentioned levels

Buy above 2945 Tgt 2970,3008 and 3050.5 SL 2933

Sell below 2925 Tgt 2908,2870 and 2844 SL 2933

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for July Month, Intraday Profit of 3.57 Lakh and Positional Profit of 4.79 Lakh. Please note we do not have any “ADVISORY Service”, I share this sheet to see how the system are performing and money can be made in Stock Market if System are followed with discipline. Also the performance differs from trader to trader.

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/14011718

Sir please explain how to trade with these type of calls

Amar Raja Holding 932 TGT 966/987

sir there is typing error in Aug month positional performance sheet,please rectify.thank you

thanks a lot will do that..

means that wait and let the stock cool down and clear trend….smeetsingla

If Open = High avoid taking Buy Trade and if Open = Sell avoid taking the SELL trade on the given day. WHAT IT MEANS

i take ICICI BANK AUGUST FUT sir

Dear sir, last week 28/7/16 Thursday I take position for ICICI BANK FUT 272 , what i do ? sir

You need to exit.. Trade was close above 272 on 27 it closed exactly at 272 you need to exit.. Even if you took next day it traded below 272 for 1 hour and also closed below 272 u need to exit .. Please follow rules.. Do trading in cash market for 3-5 months get comfortable than trade futures..

If Open = High avoid taking Buy Trade and if Open = Sell avoid taking the SELL trade on the given day. WHAT IT MEANS

Means if Open and High is not broken trend can remain bearish hence avoid taking buy trade

dear Sundar u learn tech analysis so that u will understand why he is giving different levels for buying & selling.More over if u know the reason u will have greater confidence in your trading