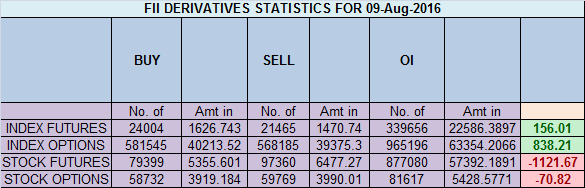

- FII’s bought 2.5 K contract of Index Future worth 156 cores ,5.6 K Long contract were added by FII’s and 3.1 K short contracts were added by FII’s. Net Open Interest increased by 8.7 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures. Why You Can’t Cut Losses

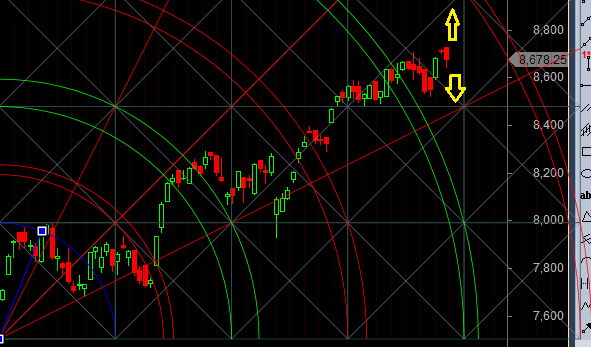

- As discussed in Yesterday Analysis Bulls need to protect 8677 in any correction to continue upmove towards 8800/8851 zone as seen in below gann chart. Nifty closed just a tad above 8678 suggesting bulls are in control,holding 8678 bulls can again move towards 8849. Bears will get active only on close below 8577 in between again time correction. Bank Nifty close above 18915, EOD Analysis

- Nifty Aug Future Open Interest Volume is at 2.46 core with liquidation of 0.29 Lakh with increase in cost of carry suggesting long position were closed today, NF Rollover cost @8650, closed above it.

- Total Future & Option trading volume was at 3.04 Lakh core with total contract traded at 1.2 lakh , PCR @0.92, Trader’s Resolutions for the New Financial Year 2016-17

- 8800 CE is having Highest OI at 51.2 lakh, resistance at 8800 .8500/9000 CE added 19.5 lakh so resistance formation in 8800-8900 zone .FII bought 5.5 K CE longs and 6.3 K CE were shorted by them .Retail bought 55.8 K CE contracts and 33 K CE were shorted by them.

- 8500 PE OI@55.2 lakhs having the highest OI strong support at 8500. 8300-8800 PE added 0.29Lakh in OI so bulls making strong base near 8550-8600 zone .FII bought 17.1 K PE longs and 3 K PE were shorted by them .Retail bought 15 K PE contracts and 18.9 K PE were shorted by them.

- FII’s bought 144 cores in Equity and DII’s sold 610 cores in cash segment.INR closed at 66.84

- Nifty Futures Trend Deciding level is 8702 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8674 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8700 Tgt 8725,8750 and 8771 (Nifty Spot Levels)

Sell below 8660 Tgt 8640,8620 and 8600 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586Follow on Twitter:https://twitter.com/brahmesh

can’t understand clearly what to do….today there was a bloodbath ….is it the start or just a correction??

Good example to show that closing above or below a level cannot decide the future course for a trader..8677 has no relevance, only stoplosses are relevant

8677 did showed it relevance by showing an impulsive move.. without SL a trader can never trade but knowing the bigger trend on closing basis is always required..

Just a correction of 100 points cannot be termed as blood bath.. Whenever there is confusion no clarity best is to sit out

Excellent comment

Thanks everyone …

does nifty formed a hanging man candlestick pattern which signifies buyers are loosing control and a short term top is near ?

Hello Sir,

I have been reading a few articles where Trump and Gundlach have been indicating that this increase in stock market is a big bubble and it is better to sell and move.

What is your thinking? and would you advise to short sell stocks at this point of time.

Regards

Vandana Yadav

You can initiate short sell at new life time high of nifty at 91xx range..until then no short selling..

It would be foolish to do that without knowing if the trend is up or down at that point of time. Technically making a new lifetime high is bullish as a standalone indicator. The Quarterly Charts will be clear indicator on the trend, along with the VIX. I don’t know if anyone noticed this in the last three weeks. VIX is displaying complacency, weak bulls are about to be taken to the cleaners in the coming few weeks. But that does not mean that we are in a bear market yet. Check the charts of US VIX and India VIX and you will know what I mean.

Predict and Perish..

🙂

Golden words !!

Sir, Did nifty formed Top for current series?

if 8500 not broken it can move back up again..

Hi Vandana , you are right. Market will decimate taking us offguard Nifty Bottom is 5700

Dear KS,

Market has a habit of first decimating opinionated traders before actually following their opinions..

Just my 2 cents..