Introduction

The Detrended Price Oscillator attempts to filter out trend in order to focus on the underlying cycles of price movement. Detrended prices allow you to more easily identify cycles and overbought/oversold levels. The Detrended Price Oscillator (DPO) is used to remove trend from price. This is done in order to identify and isolate short-term cycles. DPO is not typically aligned with the most current prices. It is offset to the left (the past) which helps to remove current trend. Because it is offset to the past, the DPO is not considered a momentum oscillator. It only measures past prices against a Simple Moving Average as a way to gauge a cycle’s high/low range as well as typical duration.

Long-term cycles are made up of a series of short-term cycles. Analyzing these shorter term components of the long-term cycles can be helpful in identifying major turning points in the longer term cycle. The DPO helps you remove these longer-term cycles from prices.

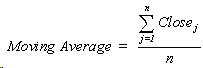

Calculation

To calculate the DPO, you specify a time period. Cycles longer than this time period are removed from prices, leaving the shorter-term cycles.

First create an n-period simple moving average (where “n” is the number of periods in the moving average).

Now, subtract the moving average “(n / 2) + 1” days ago, from the closing price. The result is the DPO.

![]()

N refers to the number of periods used to calculate the Detrended Price Oscillator. A 20-day DPO would use a 20-day SMA that is displaced by 11 periods {20/2 + 1 = 11}. This displacement shifts the 20-day SMA 11 days to the left, which actually puts it in the middle of the look-back period. The value of the 20-day SMA is then subtracted from the price in the middle of this look-back period. In short, DPO(20) equals price 11 days ago less the 20-day SMA. The Detrended Price Oscillator is most effective with indicator periods of 21 days or less.

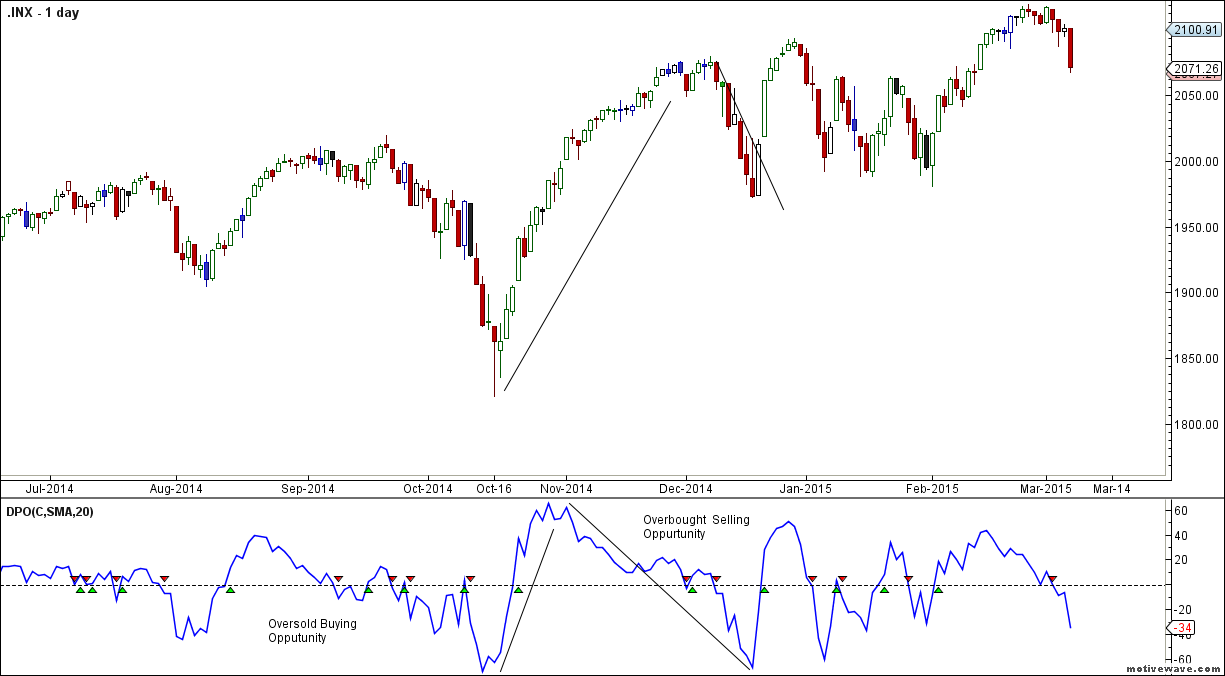

The following chart shows the 20-day DPO of Ryder. You can see that minor peaks in the DPO coincided with minor peaks in Ryder’s price, but the longer-term price trend during June was not reflected in the DPO. This is because the 20-day DPO removes cycles of more than 20 days.

How to Trade Using Detrended Price Oscillator

The real power of the Detrended Price Oscillator is in identifying turning points in longer cycles:

- When Detrended Price Oscillator shows a higher trough – expect an upturn in the intermediate cycle;

- When Detrended Price Oscillator experiences a lower peak – expect a downturn in the intermediate cycle;

Next Article Will Cover how to trade using DPO

is there any tool to calculate tht??

Motivewave does that