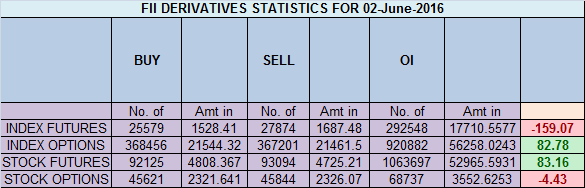

- FII’s sold 2.2 K contract of Index Future worth 159 cores ,1.6 K Long contract were liquidated by FII’s and 0.06 K short contracts were added by FII’s. Net Open Interest decreased by 0.09 K contract, so rise in market was used by FII’s to exit long and enter shorts in Index futures.Mindset Shifts for successful trading

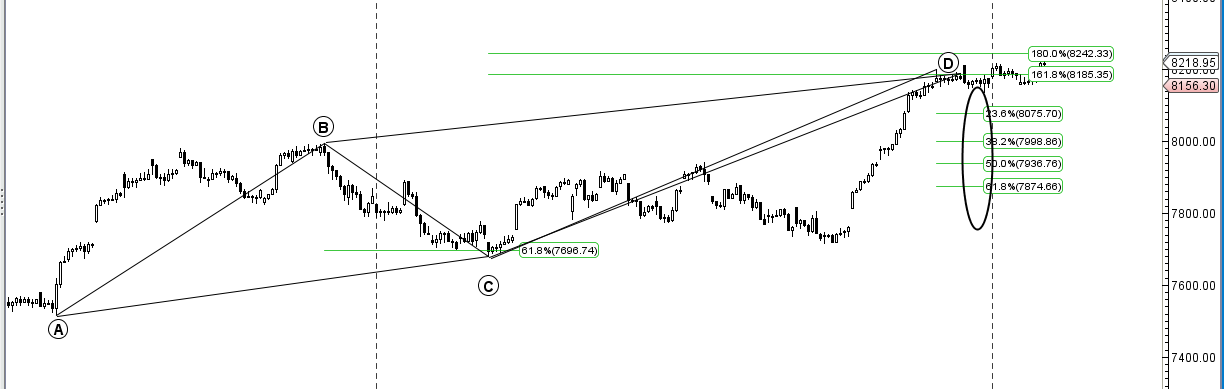

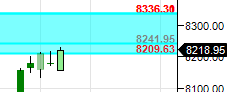

- As discussed in Yesterday Analysis 8210-8241 is crucial as its a supply zone and also PRZ zone of ABCD pattern, Unable to close above it we can see down move till 8075/8100. High made today was 8229, Bulls needs a close above 8210-8241 range for next move towards 8336/8400 else correction till 8075/8000. ABCD pattern will get invalidated on close above 8242. Weekly closing tomorrow, Bulls would like to close above 8210 which will trigger a new gann cycle which can move till 8336/8410/8557. As we have said in previous analysis till 7972 is protected trend is buy on dips. Will Bank Nifty close above 17670,EOD Analysis

- Nifty June Future Open Interest Volume is at 2.15 core with addition of 0.2 Lakh with increase in cost of carry suggesting long position were added today, NF Rollover cost @7961 closed above it

- Total Future & Option trading volume was at 1.81 Lakh core with total contract traded at 1.38 lakh , PCR @0.94, Trader’s Resolutions for the New Financial Year 2016-17

- 8400 CE is having Highest OI at 43.3 lakh, resistance at 8400 .8000/8600 CE bought 11.3 lakh so bears forming resistance at higher levels as nifty unable to close above 8241 .FII bought 7.2 K CE longs and 7 K CE were shorted by them .Retail sold 28.4 K CE contracts and 5.9 K CE were shorted by them.

- 8000 PE OI@62.5 lakhs having the highest OI strong support at 8000. 8000-8600 PE added 8.7 Lakh in OI so strong base near 8000-8100 zone .FII bought 11.5 K PE longs and 10.4 K PE were shorted by them .Retail sold 8.8 K PE contracts and 1.8 K shorted PE were covered by them.

- FII’s bought 521 cores in Equity and DII’s sold 576 cores in cash segment.INR closed at 67.29

- Nifty Futures Trend Deciding level is 8201 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8159 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8250 Tgt 8275,8300 and 8332 (Nifty Spot Levels)

Sell below 8200 Tgt 8180,8150 and 8125 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

Retail had covered the shorted ~6k index CE on 2nd june you have mentioned they sold 6K. Kindly confirm. I need to be sure of my mistake.. Your analysis is in-depth and self-explanatory. Thanks

thanks

thanks Musaji..

this whole week nifty moved in range of just 50-60 points. was it a consolidation after 350 point movement. now closed above 8210, so a new gann cycle which can move till 8336/8410/8557 is on the cards???

Close is at 8210, so new cycle will trigger with mentioned targets till we have weekly close above 8210

@ 8210, i am seeing it at 8,220.80

Hi Bramesh,

what do you meant by invalidating abcd pattern… what is the expected move, if nifty close above 8242

Means SL triggred.. 8336

Very eager to read your articles

Sir,what trading software do you use.Mine doesnt have gann arc.

Gunner

Neat presentations of all specific analysis…thank you

really informative.