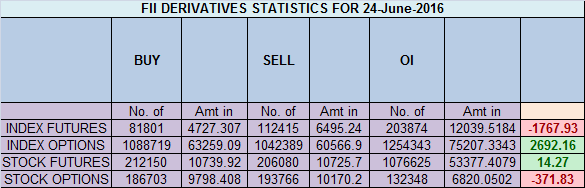

- FII’s sold 30.6 K contract of Index Future worth 1767 cores ,30.9 K Long contract were liquidated by FII’s and 327 short contracts were liquidated by FII’s. Net Open Interest increased by 31.2 K contract, so fall in market was used by FII’s to exit long and exit shorts in Index futures.Its all about Will power, Amazing Story of Girish Gogia

- As discussed in Yesterday Analysis Nifty did close above 8210 suggesting a bullish set up but the overnight news event on Brexit did a gap down of almost 250 points. As i always suggest if you are trader with small capital do not take aggressive position before the event, and if you take you should be properly hedged, Its just like Term Insurance which will make sure you do not suffer a big blow in your trading account. Always remember trading is all about Risk Management, Manage Risk Profits will follow. Another aspect which i want to point is having a proper plan, As we have been discussing in Weekly Analysis As per Supply Demand Analysis Till we do not close above 8336 we can see the possibility of going down till 7921, Low made was 7927 and we saw swift recovery of more than 150 points, Having a plan is whats make the difference. For next 4 days 8111 will play a important role on upside and 7972 on downside, breaking any one of the levels can see move 8210/8241 on upside and 7921/7777 on downside. Bank Nifty reacts furiously from gann arc, EOD Analysis

- Nifty June Future Open Interest Volume is at 1.34 core with liquidation of 24.5 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7961 closed above it

- Total Future & Option trading volume was at 6.48 Lakh core with total contract traded at 4 lakh , PCR @0.94, Trader’s Resolutions for the New Financial Year 2016-17

- 8400 CE is having Highest OI at 55.1 lakh, resistance at 8400 .8300/8300 CE added 38.5 lakh so bears forming resistance at higher levels 8200-8300 zone .FII bought 7.1 K CE longs and 10.7 K CE were shorted by them .Retail bought 72.5 K CE contracts and 1 K CE were shorted by them.

- 8000 PE OI@65.8 lakhs having the highest OI strong support at 8000. 8000-8600 PE liquidated 76.2 Lakh in OI so bulls making strong base near 7900-8000 zone .FII bought 18 K PE longs and 31.8 K PE were shorted by them .Retail sold 62.5 K PE contracts and 390 shorted PE were covered by them.

- FII’s sold 629 cores in Equity and DII’s bought 115 cores in cash segment.INR closed at 67.49

- Nifty Futures Trend Deciding level is 8012 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8185 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 8050 Tgt 8080,8106 and 8135 (Nifty Spot Levels)

Sell below 8000 Tgt 7976,7950 and 7921 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Follow on Twitter:https://twitter.com/brahmesh

FII’s sold 30.6 K contract of Index Future worth 1767 cores ,30.9 K Long contract were liquidated by FII’s and 327 short contracts were liquidated by FII’s. Net Open Interest increased by 31.2 K contract..

sir g kya ye correct hain both side liquidation hua hain phir open interest increased

thanks it corrected..

Nifty is already 8088. Chopad levels says to buy. So can we buy at opening if its above 8050

Nifty will open below 8050 tomorrow because DOW slipped after 11:30 on friday, the adjustment in nifty will bring it below 8050.

Nifty is already 8088. Chopad levels says to buy. So can we buy at opening if its above 8050

yes u can

Though not a price action, a very old adage was proven right again. Sell the rumor and buy the news.