Last Week we gave Chopad Levels of 8120, Nifty gave short entry on Monday, and did 1 target on downside and also gave long entry on Wednesday which also did 1 target. Coming week Market will start with Rexit action & will end with Brexit reaction. Impact of RaghuRam Rajan Exit on Indian Markets

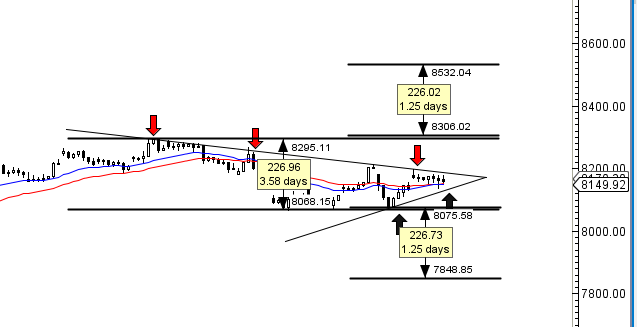

Nifty Hourly Chart

Hourly Chart is forming triangle, pattern is forming, break of 8075 can see 7848 and above 8295 can see 8532 levels in medium term.

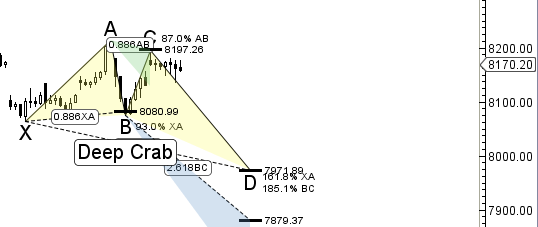

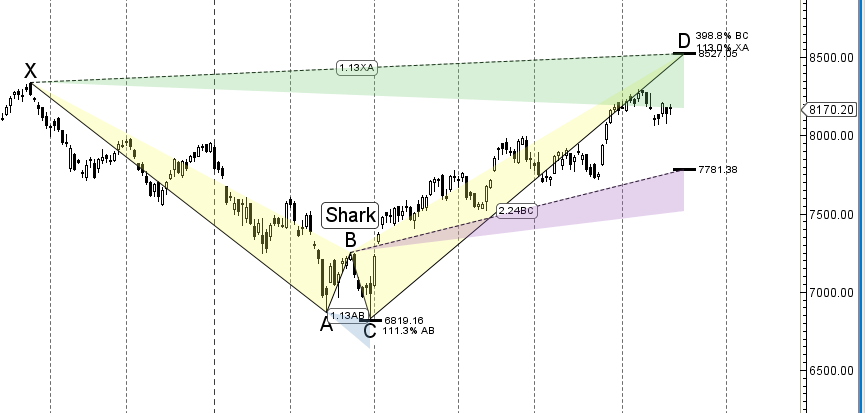

Nifty Harmonic

As Nifty did not hold on to 8242-8262 range so the downmove can end near 7971 as per Deep Crab Pattern.

On Daily we have a Bullish Shark pattern forming which till we held on to 7972 can see move till 8500-8527 in medium term.

Nifty Gann Angles

Nifty s coming near the gann angle, so if 8100-8120 range is held we can see another upmove. Else we will move down to 8000 odd levels.

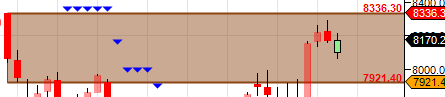

Nifty Supply and Demand

Next move towards 8336 holding 8000.

Nifty Gann Date

Nifty As per time analysis 22 June is Gann Turn date , except a impulsive around this dates.

Nifty Gaps

For Nifty traders who follow gap trading there are 6 trade gaps in the range of 7000-9000, rest all gaps were filled in the last week fall.

- 7222-7308

- 7368-7406

- 7748-7809

- 7934-7948

- 8069-8077

- 8937-8891

Nifty Weekly Chart

It was Positive week, with the Nifty up by 0.15 points closing @8170.Nifty has been trading in the weekly channel as shown above, from the low of 6825, Now we need to hold 8134-8100 range for another up move towards 8500-8550 range, Nifty did not close below 8100 for the last week. Bulls failed to hold 8210 on weekly closing basis for next move till 8577, but for coming week if 8100-8120 range is held we can see another attempt to close above 8210.

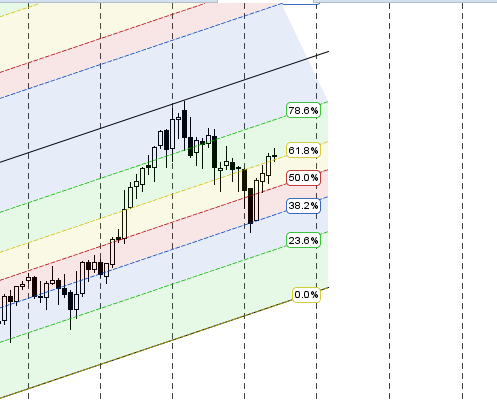

Trading Monthly charts

Monthly closed above 61.8% retracement ,signaling bulls have upper hand

Nifty Weekly Chopad Levels

Nifty Trend Deciding Level:8085

Nifty Support:8000,7935 ,7852

Nifty Resistance:8150,8210,8300

Levels mentioned are Nifty Spot

Let me go by Disclaimer these are my personal views and trade taken on these observation should be traded with strict Sl.Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Want to see post in your Inbox,Register by adding your email id in Post in your Inbox section

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Follow on Twitter during Market Hours: https://twitter.com/brahmesh

sir for trend deciding level, does we have to see nifty last traded price or closing price which is avg of last 30 min. like what can we intereprete from today nifty close …bulish or bearish. pls reply sir

bta do sirji

Excellent ji .Today how did you exactly supported with Chopad level .Great!

Nice

Sir ji.. Your analysis of nifty is excellent. thanks a lot for supporting us who do not know this much technicals

Hi Brameshji

In Nifty Weekly Chopad level, by mistake Nifty Support & Resistance Levels are interchanged ie. ACTUAL SUPPORT LEVEL FIGURES ARES SHOWN IN RESISTANCE & VICE VERSA.

Thanks for ur Weekly Guidance

Thanks its corrected..

Pl recheck weekly chopad levels..