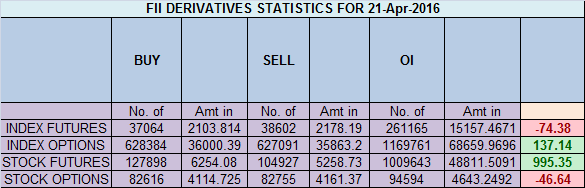

- FII’s sold 1.5 K contract of Index Future worth 74 cores ,2.7 K Long contract were added by FII’s and 4.3 K short contracts were added by FII’s. Net Open Interest increased by 7.1 K contract, so fall in market was used by FII’s to enter long and enter shorts in Index futures.How Fear and Greed affects trading

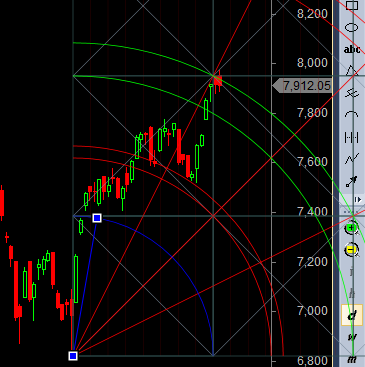

- As discussed in last analysis Bulls need a close above 7950/7972 range to continue the rise further else we can see a dip till 7850/7800 range. High made today was 7978 exactly at gann arc, closed below both 7950/7972. So Bulls are not doing a good job as we are unable to close above 7972. So we can trade between 7850-7972 range before taking next move. Till close is above gann number of 7850 bulls are in control Bank Nifty does 16700, EOD Analysis

- Nifty April Future Open Interest Volume is at 1.59 core with liquidation of 4.1 Lakh with decrease in cost of carry suggesting long position were closed today, NF Rollover cost @7740, Nifty future opened above it and rallied

- Total Future & Option trading volume was at 3.21 Lakh core with total contract traded at 1.6 lakh , PCR @1.10, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 75 lakh, resistance at 8000 .7500/8000 CE liquidated 1.3 lakh so bears liquidated as we closed above 7850 .FII bought 2.8 K CE longs and 16.3 K shorted CE were covered by them .Retail bought 27.9 K CE contracts and 29 K CE were shorted by them.

- 7800 PE OI@63 lakhs having the highest OI strong support at 7800. 7500-8000 PE added 3.6 Lakh in OI so strong base near 7800 .FII bought 550 PE longs and 18.5 K PE were shorted by them .Retail bought 4.6 K PE contracts and 10 K shorted PE were covered by them.

- FII’s bought 805 cores in Equity and DII’s bought 65 cores in cash segment.INR closed at 66.39

- Nifty Futures Trend Deciding level is 7938 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7749 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7925 Tgt 7950,7975 and 8000 (Nifty Spot Levels)

Sell below 7870 Tgt 7850,7830 and 7806 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

Bro,

I guess there is a copy paste issue. You have used the 21st Aprils table for FII/DII. The data after 22nd is little different.

thanks its corrected..

nifty buy break recent high (appox 8030) then sell