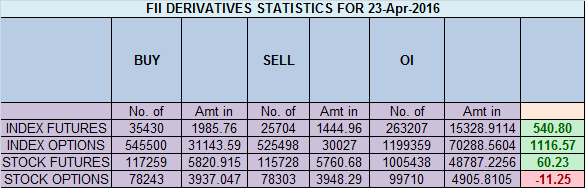

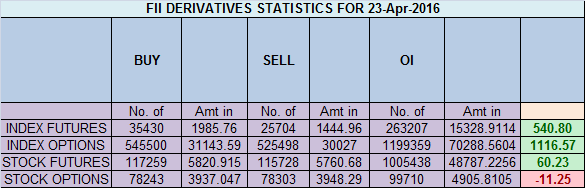

- FII’s bought 9.7 K contract of Index Future worth 540 cores ,5.8 K Long contract were added by FII’s and 3.8 K short contracts were liquidated by FII’s. Net Open Interest increased by 2 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures. If only our mind is like a plain mirror

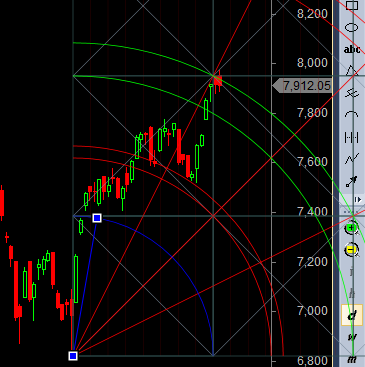

- As discussed in last analysis So we can trade between 7850-7972 range before taking next move. Till close is above gann number of 7850 bulls are in control High made was 7923 and Low 7873 so nifty keeping both bulls and bears in LIMBO, and we are having more of time correction where market remains in a range thus options losing premium and option writes making a merry. Bank Nifty struggling near supply zone,EOD Analysis

- Nifty April Future Open Interest Volume is at 1.56 core with liquidation of 2.8 Lakh with increase in cost of carry suggesting short position were closed today, NF Rollover cost @7740, Nifty future rallied 200 points above this level.

- Total Future & Option trading volume was at 2.96 Lakh core with total contract traded at 1.3 lakh , PCR @1.10, Trader’s Resolutions for the New Financial Year 2016-17

- 8000 CE is having Highest OI at 73.3 lakh, resistance at 8000 .7800/8000 CE liquidated 5 lakh so bears liquidated as we closed above 7850 .FII bought 14.7 K CE longs and 7.2 K CE were shorted by them .Retail bought 9.6 K CE contracts and 7.9 K CE were shorted by them.

- 7800 PE OI@66 lakhs having the highest OI strong support at 7800. 7800-8000 PE added 3.9 Lakh in OI so strong base near 7800 .FII bought 10 K PE longs and 2.4 K shorted PE were covered by them .Retail sold 15 PE contracts and 5.8 K PE were shorted by them.

- FII’s bought 191 cores in Equity and DII’s sold 168 cores in cash segment.INR closed at 66.48

- Nifty Futures Trend Deciding level is 7912 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7761 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7925 Tgt 7950,7975 and 8000 (Nifty Spot Levels)

Sell below 7870 Tgt 7850,7830 and 7806 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-14011718268586

any harmonic pattern visible in nifty bhandari sahab ??

shark for tgt of 8095

Dear Brameshji,

Please update Derivative Stats for 22-Apr. Image displayed is older.

limbo means

Confusion