Zee

Positional/Swing Traders can use the below mentioned levels

Close above 390 Tgt 398/411

Intraday Traders can use the below mentioned levels

Buy above 388 Tgt 392,396 and 402 SL 386

Sell below 385 Tgt 382.8,379 and 376 SL 387

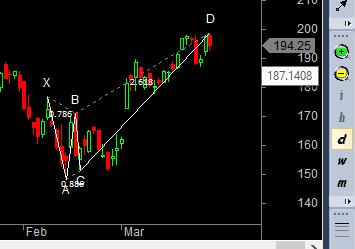

SBIN

Positional/Swing Traders can use the below mentioned levels

Unable to close above 200 Tgt 178

Intraday Traders can use the below mentioned levels

Buy above 195.2 Tgt 197.4,199 and 201.5 SL 194

Sell below 191 Tgt 189,187 and 185 SL 192.2

IOC

Positional/Swing Traders can use the below mentioned levels

Close below 390 Tgt 377

Intraday Traders can use the below mentioned levels

Buy above 398 Tgt 401 ,404.2 and 410 SL 395

Sell below 391 Tgt 387.5,384 and 381 SL 395

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for March Month, Intraday Profit of 3.22 Lakh and Positional Profit of 6.46 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

In April performance sheet, SBI trade is not clear. Buy trade entered at 193 and exited at 184 is shown as a profitable trade. Also buy entry of 103 is not as per the levels given above for SBI.

Please read the analysis, Unable to clsoe above 200 Tgt 178 As for 3 days its not able to comes near 200 we took the trade.

Rgds,

Bramesh

Dear Sir,

Zeel short call SL hitted, and 1st tgt is of 2.20 pts but u have mentioned 1.20 partial. Plz guide me so that i can trade accordingly. Thanks.

Hi Sir,

As Low made was 383.1 and 1 Tgt was 382.8 so we should raise Sl and my increased SL was hit at 383.8

Rgds,

bramesh

It is related to SBI call.

“Unable to close above 200 Tgt 178” It means if it doesn’t close above on the given date (I mean date on which call is given).

These are positional calls, which are valid through out the April series.