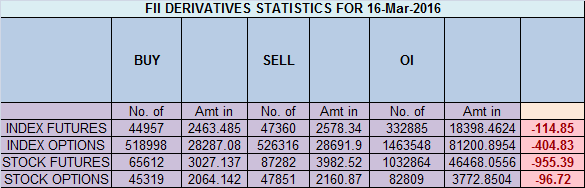

- FII’s sold 2.4 K contract of Index Future worth 114 cores ,10.9 K Long contract were added by FII’s and 13.3 K short contracts were added by FII’s. Net Open Interest increased by 24.3 K contract, so fall in Nifty market was used by FII’s to enter long and enter shorts in Index futures. How “Not learning” from Trading Mistakes can be Disastrous

- As discussed in Last Analysis Nifty finally has a correction of more than 100 points, its a slow and steady fall we are seeing from past 2 session, as Nifty was unable to move above the gann trendline as shown in below chart, Bulls need close above 7554 for a move towards 7634. Bears below 7400 for move towards 7350/7228 else it will be sideways move in small range. Nifty made low of 7405 near the demand zone and gann arc support zone forming hammer candlestick. Also Nifty took almost 17 hours to correct from 7583-7401 and half of it was covered in 3 hours which shows the underlying trend is bullish, Bulls need close above 7554 for a move towards 7634. Bears below 7400 for move towards 7350/7228 Bank Nifty near gann trend line, EOD Analysis

- Nifty March Future Open Interest Volume is at 2.17 core with liquidation of 1.2 Lakh with increase in cost of carry suggesting long position were added today, NF closed above Rollover cost @7147. Nifty rallied 300 points above Rollover cost

- Total Future & Option trading volume was at 2.46 Lakh core with total contract traded at 1.89 lakh , PCR @0.89, .How To Identify Market Tops and Bottom

- 7500 CE is having Highest OI at 70.4 lakh, resistance at 7500 .7000/7500 CE liquidated 1.6 lakh so bears ran for cover as Nifty bounced from demand zone .FII bought 9.9 K CE longs and 22.9 K CE were shorted by them .Retail bought 8.8 K CE contracts and 2.5 K shorted CE were covered by them.

- 7200 PE OI@63.6 lakhs having the highest OI strong support at 7200 base becoming strong. 7200-7600 PE added 15.9 Lakh in OI .FII bought 22.5 K PE longs and 16.8 K PE were shorted by them .Retail bought 9 K PE contracts and 9.9 K PE were shorted by them.

- FII’s bought 625 cores in Equity and DII’s sold 680 cores in cash segment.INR closed at 67.22

- Nifty Futures Trend Deciding level is 7482 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7351 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7510 Tgt 7536,7573 and 7600 (Nifty Spot Levels)

Sell below 7450 Tgt 7430,7400 and 7370 (Nifty Spot Levels)

Follow on Facebook https://www.facebook.com/Brameshs-Tech-140117182685863/

Dear Bramesh,

I would like to get hold of a software copy that you make use of to draw Gann angles. I am yet to find a decent charting tool on the web. Can you please let me know where to find one?

Thanks and have a good day.

Kind Regards,

Sandeep M

Dear Sir,

We do not use web based charting tool.

Rgds,

Bramesh

Dear Mr Bramesh,

Thanks for the reply. May I have the liberty of knowing the software you use? Is it available for purchase and if Yes what would be the pricing on the same?

Kind Regards,

Sandeep.M

Sandeep,

Its Gunner 24

Sorry instead of 12K its 10.9K … Brahmesh Sir’s figure is correct probable the statement has a typo

correct FII have added 13.4K contracts short positions and around 12K contracts long… So they have actually added short position.. it is DII who has added some long positions

was used by FII’s to enter long and exit shorts in Index futures

I think it should be both enter long and enter shorts as they also created short positions today.

Thanks its corrected.

if fii short but but market open high today