- FII’s bought 9.8 K contract of Index Future worth 607 cores ,4.9K Long contract were added by FII’s and 4.8 K short contracts were liquidated by FII’s. Net Open Interest increased by 0.03 K contract, so fall in market was used by FII’s to enter long and exit shorts in Index futures. Why Trading the most difficult profession ?

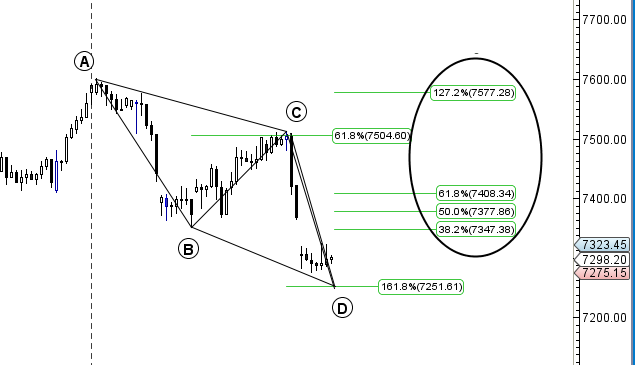

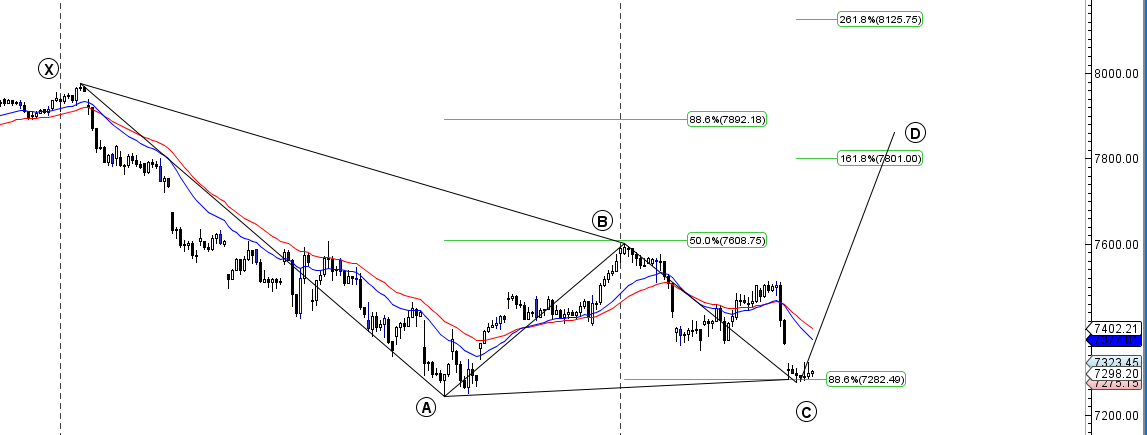

- As discussed in Last Analysis If we close below 7366 it mean high probability of nifty break 7230,if we make low in range of 7318-7292 and bounce back than we might be forming BAT pattern as discussed in weekly analysis which will have bullish implication going forward. Nifty closed below 7300 and made low of 7275 to full fill BAT pattern condition now if we do not break 7230 we might rally to form the final leg of BAT pattern, any close below 7230 invalidates the pattern. Also a small ABCD pattern can be seen which gets completed in range of 7257-7230 so again 7230 needs to be watched for next 2 days to see if patterns are failed or we see some relief rally Bank Nifty corrects from Pyrapoint Resistance,EOD Analysis

- Nifty February Future Open Interest Volume is at 1.85 core with liquidation of 7.4 Lakh with increase in cost of carry suggesting short position were closed today, Nifty Future closed below the Rollover cost @7419.

- Total Future & Option trading volume was at 2.32 Lakh core with total contract traded at 1.85 lakh , PCR @0.83 .How To Identify Market Tops and Bottom

- 7600 CE OI at 61.1 lakh , wall of resistance @ 7600 .7200/7600 CE added 27.9 lakh in OI addition major addition was seen in 7300/7400 CE .FII sold 14.3 K CE longs and 0.05 K shorted CE were covered by them .Retail bought 59.1 K CE contracts and 24.7 K CE were shorted by them.

- 7200 PE OI@48.3 lakhs having the highest OI strong support at 7200 . 7100/7600 PE added 9.1 lakh so bulls added 7200/7100 .FII bought 72.7 K PE longs mostly in 7100/7200 PE so till NF stays below today’s high market can go down and 2.5K shorted PE were covered by them .Retail sold 20 K PE contracts and 34.2 K PE were shorted by them.

- FII’s sold 680 cores in Equity and DII’s sold 174 cores in cash segment.INR closed at 67.89

- Nifty Futures Trend Deciding level is 7324 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7465 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7298 Tgt 7322,7345 and 7370 (Nifty Spot Levels)

Sell below 7270 Tgt 7250,7226 and 7200 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

What is BAT pattern and what are its levels ? Sir I have been following your analysis and highly impressive. Today’s close has been just at 7252 and above 7230. So what next how do we analyze moving ahead.

Sir. 7230 broke down in today’s trade. So where are we going now. Where is the next support level. Are we moving towards 6800? Thanks

Let it close below it.. If it does 7118 is next support.

CLEAR CUT ANALYSIS

TKS

Excellent analysis….

Pls clarify, Since if FIIs bought huge puts…Nifty going to touch 7100 levels before any rally starts?

Ty

Will surely break 7230 lets wait and watch

if we do not break 8230 we might rally to form the final leg of BAT pattern

I think it should be 7230. Excellent analysis as always. FII bought 72.7 K PE longs. This looks like a huge addition. FII Planning for a big move soon?