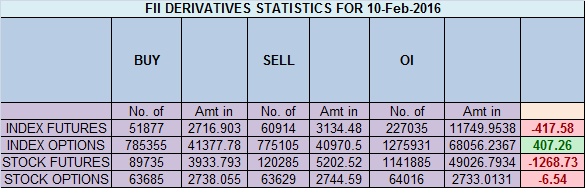

- FII’s sold 9 K contract of Index Future worth 417 cores ,65 Long contract were added by FII’s and 9 K short contracts were added by FII’s. Net Open Interest increased by 9.1 K contract, so fall in market was used by FII’s to enter small qty long and enter good amount of shorts in Index futures. Bad Trading Habits and How to Avoid Them

- As discussed in Last Analysis Nifty closed below 7300 and made low of 7275 to full fill BAT pattern condition now if we do not break 7230 we might rally to form the final leg of BAT pattern, any close below 7230 invalidates the pattern. Also a small ABCD pattern can be seen which gets completed in range of 7257-7230 so again 7230 needs to be watched for next 2 days to see if patterns are failed or we see some relief rally. Nifty closed below 7230 made low of 7177 before bouncing back, if tomorrow also we close below 7230 we are heading towards 7118/7120, which is demand zone and very important GANN Number, if 7120 is held we can see a sharp and shift move on upside. Bullish on close above 7230 Will Bank Nifty bounce from 14338 zone, EOD Analysis

- Nifty February Future Open Interest Volume is at 1.86 core with addition of 1 Lakh with increase in cost of carry suggesting long position were added today, Nifty Future closed below the Rollover cost @7419 and gave 200 points profits till now

- Total Future & Option trading volume was at 2.84 Lakh core with total contract traded at 2.4 lakh , PCR @0.78,VIX is very high Option buyers need to be very cautious any fall in vix will lead to fast fall in Option premium .How To Identify Market Tops and Bottom

- 7500 CE OI at 59.9 lakh , wall of resistance @ 7500 .7100/7600 CE added 52 lakh in OI addition major addition was seen in 7300/7400 CE .FII sold 15.9 K CE longs and 25 K CE were shorted by them .Retail bought 99.5 K CE contracts and 19.6 K CE were shorted by them.

- 7200 PE OI@50.4 lakhs having the highest OI strong support at 7200 . 7100/7600 PE added 5.9 lakh so bulls added 7000/7100 .FII bought 48.3 K PE longs mostly in 7100/7200 PE so till NF stays below today’s high market can go down and 3.2 K shorted PE were covered by them .Retail bought 3.3 K PE contracts and 42.4 K PE were shorted by them.

- FII’s sold 751 cores in Equity and DII’s bought 196 cores in cash segment.INR closed at 67.85

- Nifty Futures Trend Deciding level is 7251 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7443 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Buy above 7230 Tgt 7265,7295 and 7320 (Nifty Spot Levels)

Sell below 7200 Tgt 7177,7130 and 7100 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Morning Bramesh ji – Your follower from JN Group.

Pardon my ignorance – Need your help on some of the terms you use in your daily analysis. Let me know if my understanding is correct with below definitions. I can look up the same if these are somewhere stored in your blog for my reference.

1. CE Long = Buying Call option. Money is made if Nifty spot rises.

2. PE Long = Buying Put option. Money is made if Nifty spot falls.

3. CE Short = Selling Call option. Money is made if Nifty spot falls.

4. PE Short = Selling Put. Money is made if Nifty spot rises.

“FII sold 15.9 K CE longs and 25 K CE were shorted by them .Retail bought 99.5 K CE contracts and 19.6 K CE were shorted by them.”

In above sentence , what is the difference between Sold CE Longs vs CE shorted” ?

Feel free to answer when you get time

Raghavendra

Dear Sir,

Sold CE means they were long in CE and was booked by them

Shorted CE means fresh writing was seen in CE.

Hope it clarifies.

Thanks a lot sir….now its very clear 🙂

I WILL AIM ONLY SELL OPPORTUNITY BELOW 7200

7280 first before going down tomorrow.