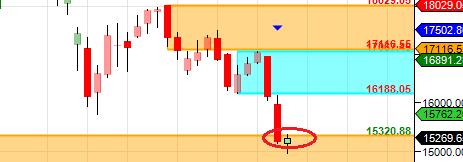

- Bank Nifty after correcting 2111 points in 11 trading days finally showed some respite to bulls and bounceback, High made today was 15338 and was unable to close above the weekly supply zone of 15320, Bulls need to close above the Weekly supply zone for more rise. Bank Nifty has closed above the gann line also and now has resistance at horizontal line @15380. So the range of 15320-15380 is very crucial closing above it bulls will rise more and unable to do so we can revisit 15000 level again. Keep losses small in order to avoid huge losses

- Bank Nifty January Future Open Interest Volume is at 28.6 lakh with LIQUIDATION of 0.81 Lakh with decrease in Cost of Carry suggesting long positions were CLOSED today .Bank Nifty rollover cost coming @ 16957 and corrected heavily one started trading below Rollover Price.How To Identify Market Tops and Bottom

- 16000 CE is having highest OI @8.5 Lakh strong resistance formation @16000. 15500 CE saw 1.2 addition by bears is next line of resistance.15000-16000 CE added 2.3 Lakh in OI, aggressive addition shown by bears,in 15500 CE.

- 15000 PE is having highest OI @5.6 lakh, strong support at 15000 and before that 14800 as it added highest OI in this series till date.14500-15500 PE saw 3 lakh addition so bulls adding below 15000/14500 where we can see potential bounceback.

- Bank Nifty Futures Trend Deciding level is 15256 (For Intraday Traders). BNF Trend Changer Level (Positional Traders) 15443.How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level . Traders who took trade as per TC levels are rewarded with almost 1500 Points

Buy above 15300 Tgt 15376,15480 and 15620 (Bank Nifty Spot Levels)

Sell below 15200 Tgt 15125,15000 and 14880 (Bank Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates