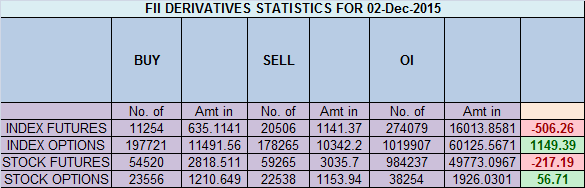

- FII’s sold 9.2 K contract of Index Future worth 506 cores ,4.6 K Long contract were liquidated by FII’s and 4.6 K short contracts were added by FII’s. Net Open Interest increased by 28 contract, so today’s fall in market was used by FII’s to exit long and enter shorts in Index futures. How Your Brain Gets In The Way of Your Trading Success

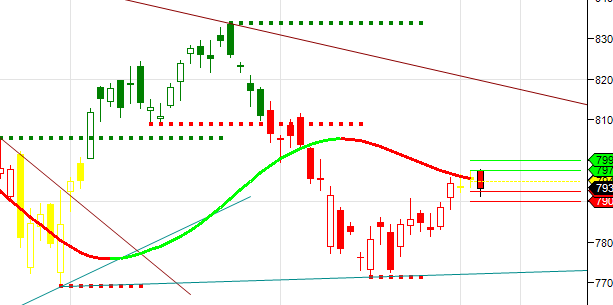

- As discussed yesterday Nifty is nearing trend change as shown in gann swing chart, Closing above 7994 will lead to trend change on upside, Till 7906 is held we can move towards 7994/8051/8116, Support is at 7906/7851. Nifty made high of 7979 unable to cross 7994 and started the fall and made low of 7911 near our demand zone of 7906 and bounced back, For next 2 days if 7906 broken we can go towards 7851/7812. Bullish only on close above 7994.Bank Nifty takes support near Gann Arc,EOD Analysis

- Nifty December Future Open Interest Volume is at 1.93 core with addition of 1.6 Lakh with decrease in CoC suggesting long position were closed today. Nifty closing above rollover cost 7896.

- Total Future & Option trading volume was at 1.29 Lakh core with total contract traded at 1 lakh , PCR @0.92.

- 8000 CE OI at 47.4 lakh , wall of resistance @ 8000 .7800/8500 CE added 19.3 lakh in OI as bears added position at higher level most of addition was seen in 8100/8300 CE.FII bought 14.4 K CE longs and 3.7 K CE were shorted by them .Retail bought 19.1 K CE contracts and 17.7 K CE were shorted by them.

- 7500 PE OI@ 46.1 lakhs strong base @ 7500. 7500/8000 PE added 2 lakh so bulls added position is 7700/7800 PE forming base at higher levels .FII bought 9.9 K PE longs and 1.1 K PE were shorted by them .Retail sold 87 PE contracts and 14.4 K PE were shorted by them. Retailers playing for range bound move.

- FII’s bought 60 cores in Equity and DII’s sold 78 cores in cash segment.INR closed at 66.59.

- Nifty Futures Trend Deciding level is 7964 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 7959 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level

Traders following TC levels have been handsomely rewarded.

Buy above 7941 Tgt 7970,7994 and 8020(Nifty Spot Levels)

Sell below 7900 Tgt 7870,7851 and 7835 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Follow on Twitter during Market Hours: https://twitter.com/brahmesh