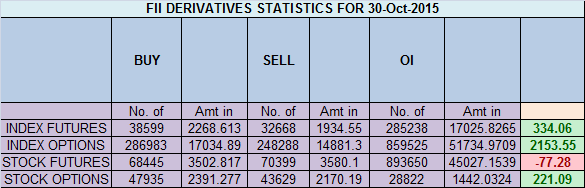

- FII’s bought 5.9 K contract of Index Future worth 334 cores ,2.3 K Long contract were added by FII’s and 3.5 K short contracts were liquidated by FII’s. Net Open Interest decreased by 1.1 K contract, so today’s fall in market was used by FII’s to enter long and exit shorts in Index futures Joy of Giving

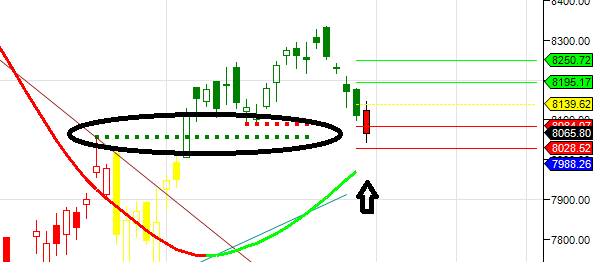

- As discussed in last analysis Nifty needs to hold 8088 unable to do so we can correct all the way till 8041/8000 Nifty continued with its fall for fifth day, correction of 292 points, Nifty took support near the gann arc and swing points as shown in below 2 charts making low near 8044 which was near demand zone of 8041 before a bouncing back but still unable to close above 8088. Support below 8041 comes at 8008/7988/7930 so these levels should be watched for a probable relief rally. Nifty needs to close above 8088 for bounceback till 8128/8209. Bank Nifty closed below demand zone, EOD Analysis

- Nifty November Future Open Interest Volume is at 1.87 core with addition of 9.4 Lakh with increase in CoC suggesting short position were added today.NF closed below the Rollover cost @8294

- Total Future & Option trading volume was at 1.70 Lakh core with total contract traded at 1.6 lakh so increase in lot size showing effect on volumes, cash volumes have jumped today suggesting traders moving to cash segments from Derivatives one . PCR @0.79. Live SGX Nifty chart from 6:30-11:30 http://sgxrtchart.blogspot.in/

- 8500 CE OI at 38.3 lakh , wall of resistance @ 8500 .8100/8400 CE added 31.8 lakh in OI so bears adding position at higher levels on first day of the series.FII bought 30.3 K CE longs and 38.4 K CE were shorted by them.Retail bought 51.1 K CE contracts and 51.8 K CE were shorted by them.

- 8000 PE OI@ 35.6 lakhs strong base @ 8000. 7500/7900 PE added 30 lakh so bulls are also building up position at the start of the series.FII bought 55.3 K PE longs and 8.4 K PE were shorted by them .Retail sold 14.9 K PE contracts and 41.6 K PE were shorted by them.FII going with bearish bias from start of series.

- FII’s sold 1469 cores in Equity and DII’s bought 1560 cores in cash segment.INR closed at 65.26.

- Nifty Futures Trend Deciding level is 8129(For Intraday Traders). NF Trend Changer Level (Positional Traders) 8148 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8088 Tgt 8101,8125 and 8146 (Nifty Spot Levels)

Sell below 8060 Tgt 8030,8000 and 7988 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir, what is sl for nifty intraday trade 20 points like for positional ? for stock intra you give sl but for nifty intra you dont give SL but you give buy above selll below only so 8088 buy then sl ? sell below is 8060 so is it SL ?

Dear Sir,

Please develop your risk management and money management , do backtesting on levels of NS find your knack and do trading.. I use 22 Points SL but every trader should develop his risk and money management.

Rgds,

Bramesh

Hello Bramesh sir,

As you have mentioned “Net Open Interest decreased by 1.1 K contract, so today’s fall in market was used by FII’s to enter long and exit shorts in Index futures “and also u have mentioned ” Nifty November Future Open Interest Volume is at 1.87 core with addition of 9.4 Lakh with increase in CoC suggesting short position were added today.” a little confusing whether FII has entered long or created short position.. pls clarify.

There are 2 Open intrest which we analysis,

1. FII which is explained in 1 line

2. Overall OI which is explained in 3 line which includes of FII’s+Clients in majority.

So fii are creating long and clients went shorts is how it should be interpreted in Index Futures.

Hi bramesh,

I have been a secret reader of your blog and great admirer of your hard work. I was also in the group of illango sir blog, but unfortunately I left trading because of my work. I do appreciate the fact that instead of putting money in any business people can read and learn skills of trading and can become full time trader. Again I wish to start trading but I have one question before you is when to enter into a trade, market opens at 9.15 there are many a times where the stock has opened above the level reached the target and many a time the stock opens up before the level and within 5 minutes it has reached the targets. Is its possible for you to elaborate the trading rules of you have any of link to the same so I can see and then backtest system. Will really appreciate.

Please read this

http://www.brameshtechanalysis.com/2014/08/how-to-trade-intraday-and-positional-calls/

Rgds,

Bramesh