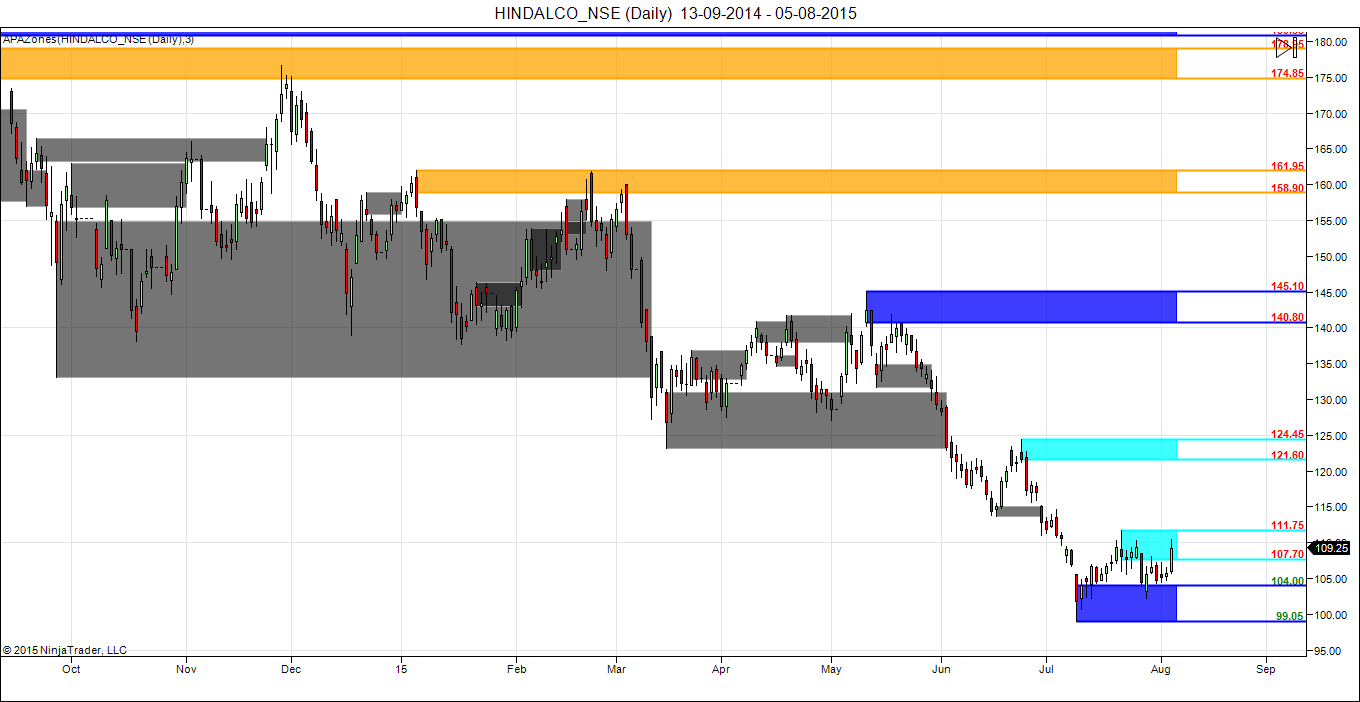

Hindalco

Positional/Swing Traders can use the below mentioned levels

Any close above 111 target 116/121

Intraday Traders can use the below mentioned levels

Buy above 110 Tgt 111,113 and 115 SL 109

Sell below 108 Tgt 106.5,104 and 102 SL 109

Exide

Positional/Swing Traders can use the below mentioned levels

Unable to close above 157 target 152/147

Intraday Traders can use the below mentioned levels

Buy above 157 Tgt 158.6,161 and 164 SL 155.5

Sell below 153 Tgt 151,149 and 147 SL 155

TVS Motor

Positional/Swing Traders can use the below mentioned levels

Any close above 234 target 238/241/246

Intraday Traders can use the below mentioned levels

Buy above 234.4 Tgt 236,238 and 241 SL 233

Sell below 231 Tgt 229,227 and 224 SL 233

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for July Month, Intraday Profit of 2.30 Lakh and Positional Profit of 3.35 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

your views on Mindtree sir??? looks like a contracting triangle is forming.. thank u

can we use Newton-Raphson, Instead of using Black-Scholes, how about using rational approximation with one or two steps of Newton-Raphson polishing for options (hybrid) method for options trading in NSE as it very fast and very accurate and practical to use. ?

Dear Bramesh

Can you please explain IV’s and also the importance in trading with examples please ?

Dear sir,

Identified a bullish harmonic pattern in a stock in a downtrend, is it good to trade the pullback rally for short term.?

yes

Any analysis on SBI for this coming result.. Just few questions- does it look buy or sell? what could be the target

will try