- FII’s bought 8.5 K contract of Index Future worth 85 cores ,8.1 K Long contract were added by FII’s and 0.4 K short contracts were squared off by FII’s. Net Open Interest increased by 7.6 K contract, so today’s market was used by FII’s to exit shorts in index futures and enter longs. Trading/Investing Mantras from Rakesh Jhunjhunwala billionaire Investor

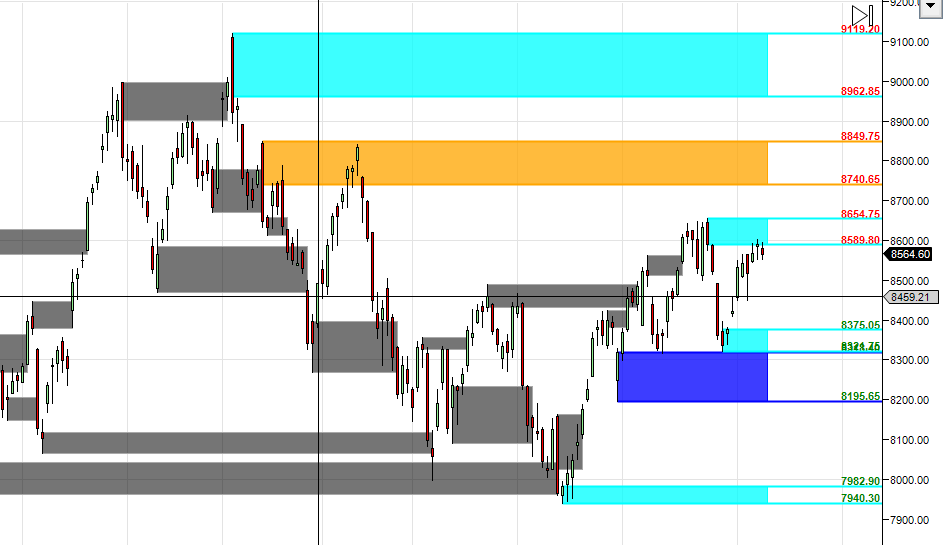

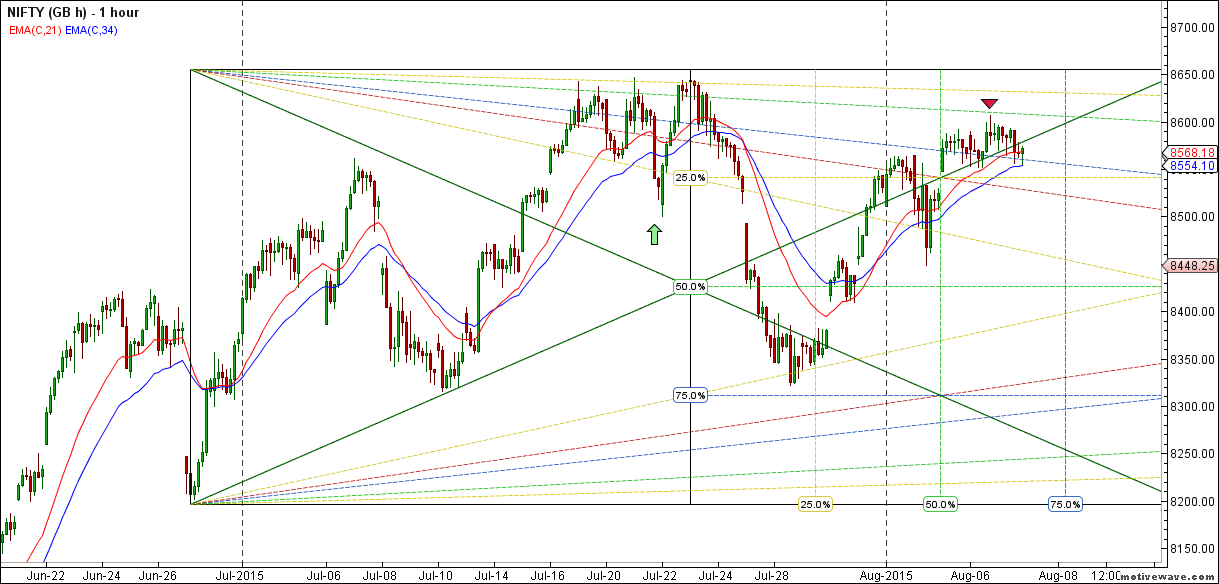

- Nifty formed INSIDE DAY pattern today as it was unable to break previous day high and low , still unable to cross crucial supply area as discussed in Weekly analysis. Today close was again below the supply area . Crossing/closing above the same we can see move to 8654 and unable to do so can see nifty again seeing pullback towards 8450/8375 odd levels.Gann Box with hourly charts are also shown with support and resistance.Nifty is also struggling to cross the daily falling trendline resistance as shown in below daily chart.

- Nifty August Future Open Interest Volume is at 1.68 core with addition of 0.5 Lakh, with increase in CoC suggesting short positions got closed today.NF Rollover price came at 8503.

- Total Future & Option trading volume was at 1.36core with total contract traded at 2.2 lakh . PCR @0.99

- 8800 CE OI at 52.3 lakh , wall of resistance @ 8800 .8400/8800 CE liquidated 1 lakh in OI so bears covered their position on small fall suggesting lack of confidence in bear camp. FII bought 15.9 K CE longs and 12.1 K CE were shorted by them.Retail bought 23.5 K CE contracts and 18.9 K CE were shorted by them.

- 8200 PE OI@ 61 lakhs strong base @ 8200. 8300/8600 PE added 2.4 lakh so addition seen in 8400/8600 PE and 86 lakh from start of series . FII bought 14.6 K PE longs and 10 K PE were shorted by them.Retail bought 24.7 K PE contracts and 26.6 K PE contracts were shorted by them.

- FII’s sold 93 cores in Equity and DII’s bought 34 cores in cash segment.INR closed at 63.81

- Nifty Futures Trend Deciding level is 8597 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8557 and BNF Trend Deciding Level 18997 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18910 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8572 Tgt 8600,8615 and 8630 (Nifty Spot Levels)

Sell below 8545 Tgt 8530,8503 and 8480 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

Sir, Icici bank 310 put has added 10 lac shares open interest. Is it a sign of strength as put has been written boldly or is it a sign that the share is to go down? i am perplexed about this type of thing happening suddenly. See in the case of bhel the share tanked but open int of calls went up. I agree the call writers will be active but who ends up buying calls? Please enlighten us by a separate post how to infer this sudden spurt in open interest?

Nifty Should cross as early as possible yesterday’s high.Otherwise we will see only downtrend in coming days.

Sir, Hope monday will be trend day and Thank you sir GN