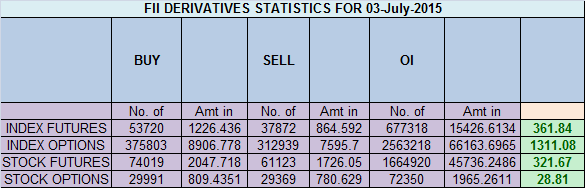

- FII’s bought 15.8 K contract of Index Future worth 361 cores ,16.4 K Long contract were added by FII’s and 0.05 K short contracts were added by FII’s. Net Open Interest increased by 16.9 K contract, so today’s rise was used by FII’s to enter longs in index futures How Markets Will React to Greek Referendum

- Nifty made high of 8497 which is 61.8% retracement from 8845-7940 and also closed above 100 DMA , Nifty also was unable to cross the pyrapoint resistance at 0 degree line as shown in below chart, Weekly Closing was above 20 WSMA. So Bulls and bears are hanging on balance as the result of Greece referendum will come on Sunday and Monday we should be 100+ move in either direction. Support are in range of 8370-8350, Resistance at 8545-8587 range.

- Nifty July Future Open Interest Volume is at 1.73 core with addition of 3.8 Lakh, with increase in CoC suggesting longs have entered system today. 34 Lakh OI added in past 3 trading session,NF Rollover range @8357 should be kept close eye on,holding below bears are in control above it bulls have upper hand.

- Total Future & Option trading volume was at 1.47 core with total contract traded at 3.6 lakh. PCR @1

- 8500 CE OI at 45.9 lakh , wall of resistance @ 8500 .8000/8500 CE added 6.5 lakh so bears added small positions and just holding 20 lakhs overall. FII bought 31.8 K CE longs and 14.7 K CE were shorted by them.Retail bought 12.9 K CE contracts.

- 8000 PE OI@ 54.6 lakhs so strong base @ 8000. 8100/8500 PE added 23.3 lakh so bulls added aggressively today before the Greece referendum and have added 106 lakh suggesting bulls are still in control of market . FII bought 49.2 K PE longs and 3.5 K PE were shorted by them.Retail bought 71.7 K PE contracts.So again retailers bought PE and market going up.

- FII’s bought 365 cores in Equity and DII’s sold 220 cores in cash segment.INR closed at 63.42

- Nifty Futures Trend Deciding level is 8475 (For Intraday Traders). NF Trend Changer Level (Positional Traders) 8390 and BNF Trend Deciding Level 18660 (For Intraday Traders) BNF Trend Changer Level (Positional Traders) 18372 How to trade Nifty Futures and Bank Nifty Futures as per Trend Changer Level .

Buy above 8513 Tgt 8542,8587 and 8645 (Nifty Spot Levels)

Sell below 8460 Tgt 8440,8388 and 8350 (Nifty Spot Levels)

Click Here to Like Facebook Page get Real time updates

that’s wt mkt played in greece

people should understand mkt in buy mode

Thank you all…for your suggestions and advice.

In derivatives, trading options with out knowing the technicals of the underlying script/index & it’s volatility is very risky game or like a game of gambling or like purchasing lottery tickets. once the time value or date is over its worthless. Out of money options only carry premium value with out any intrinsic value in it. So premium of out of money puts starts to shrink very fast once the index crosses the major resistance for example once Nifty crosses the 200 DMA around 8300 resistance strongly, it is like 8300 has become a big support for the time being so put writers will starts to short sell out of money puts so the premium starts to decay very fast. So carrying options as positional have its own merits & DEMERITS(Mostly for Retailers). Till nifty 8300 is not broken seriously (closing day basis for more than one day) till then nifty can be assumed as technically bullish break out. So traders should always respect to love technicals rather than their Emotions , Intuition, luck. Success will comes from back bone not from wish bone.

Hi Brahmesh,

Cannot zoom in in any of the charts?

Sam

Please right click on chart and open it .

Rgds,

Bramesh

I can not understand that if greec vot no then mkt down but if yes then a politycal unserntantity will in greec so thay is not good for europ govmnt will give resine nd again election will come its a dabul burdon on Greece economi which is also bank crept it is only big bulls game to manuplate world mkt

Correction in my reply .in my second line line i typed it 8669 .its an error in typing. it should be 8497.please read it 8497. extremely sorry for the error typing ..kindly bear with me

SPOT NIFTY 9119- TO 7940 IS AS PER HORMONICS FIBO .47 -THAT IS -8497 AND 8845-7940 IS 61.8 THAT IS 8669 .BUT QUESTION IS WILL IT BE A 8668 OR 8497 ? HERE AS PER MM 7/8 IS 8593 (WEAK STALL AND REVERSE ) IF SUSTAIN ABOVE IT NEXT TARGET 8/8 (ULTIMATE RESISTENCE ) IS 8750 .I STRONLY BELIEVE CURRENT 61.8 FIBO RES AT 8497 IS A BEAR TRAP.BEFORE MONSOON SESION 8750 WILL BE ACHIVED AND SELL OFF WILL BE STARTED AT 8668 (61.8) THANK YOU.

Wow brahmesh g

8512 is technical break out

& 8513 will open the door of 8668.

8300 nf put must be book SL if nf cross 8513.

If mkt opens gap up & cross 8513 just wait for intraday lower quotation, keep buying with SL of 8459. Thats the analisys of brahmesh g is saying.

All eyes on sunday greece decission & momday sgx nifty @ 7-30 am.

Happy sunday.

my friend anand bramesh sir telling many times previos day low not break uptrend continius.but friday thursday low 8433 break and closeing hightes.so uptrend continus? histrorical price action suggested chances very low.nifty continius up but volume very low. nifty continius up but bollinger band turned around.highest open intrest @8500 so upside limeted above 8500 so diffcult to cross 8630 Iam agree with mohit jain monday gap openging but nifty sustain? open ang high diffrence between 5 to 10 pointes nifty makeing high chances of bearesh engulfng candle. so nifty my target 7840 till 28 jully

We took out the 20 WMA near 8475. 8500-8550 is still major resistance. Grexit or no Grexit the uncertainty over Greece is set to continue. I am looking for a major top in the Nifty shortly.

Hi Brameshji,

I am a good follower of this blog.I have position of 700 quantity Nifty 8300 put for july contract at price of 140 on 29th june, it it was closed 72 on Friday.I completely mesded up of Greece crisis news. Please advise should i hold or square off position.

Anyone can advise technically Nifty will go down or up in coming days?

Regards,

Anand Kumar

Nice informative blog.. keep doing it..

super sir thq

Thank you sir

Now nifty close below its resistenc 8487 soing that if mkt open gapup onmonday due to greec crises than it will come down emideatly fii long position in puts in open up they will book profits thaier longs in index then they will sale to book profit in puts long positon china sale off saing that a big crash about to come in world mkt

Major profit booking level for Nifty spot comes at 8669 levels which is 61.8% retracement level from high of 9119-7940 low.Markets has taken greece saga in its strides and charts are pointing markets to move higher.Major trigger which will move our markets will be GST Bill smooth passage in moonson session.

Nifty made high of 8497 which is 61.8% retracement from 8845-7940 .Have a query if nifty were to move above 8497 would it mean it would to 100% retracement to 8845

Thank you once again for all your articles

crossing 78.6% will make sure we get to 8845

Great analysis. Thanks bramesh ji

Thank you