Tata Steel

Intraday Traders can use the below mentioned levels

Buy above 306.5 Tgt 308,311 and 314 SL 304.5

Sell below 302 Tgt 300.6, 297 and 294 SL 304

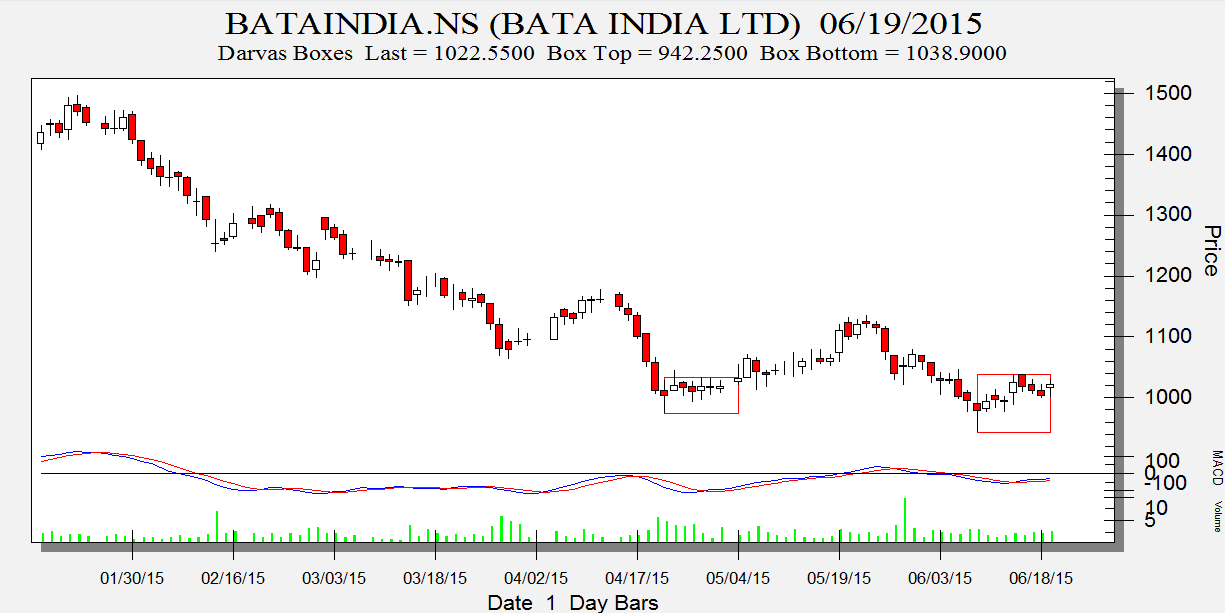

Bata India

Positional/Swing Traders can use the below mentioned levels

Any close above 1023 short term target 1042/1076

Intraday Traders can use the below mentioned levels

Buy above 1023 Tgt 1030,1038 and 1048 SL 1017

Sell below 1015 Tgt 1005, 988 and 976 SL 1020

Sun TV

Positional/Swing Traders can use the below mentioned levels

Any close above 343 short term target 356/364

Intraday Traders can use the below mentioned levels

Buy above 335 Tgt 339,343 and 348 SL 330

Sell below 328 Tgt 325, 321 and 317 SL 331

Performance sheet for Intraday and Positional is updated for May Month, Intraday Profit of 2.32 Lakh and Positional Profit of 2.07Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Thanx Bramesh…. On your point 2, are you suggesting that depending on the volatility of the stock vis a vis the market or say the indices, you would decide on the trailing stop loss ? well logically it makes sense but with 3 open positions with the possibility of another 3 trades triggering in the opposite direction ( along with some other – NF , BNF positions) i would prefer a one rule fits all approach… on the sample of last 20 days .. partial exits at T2 and T3 yields much superior result… buts thanx for the suggestion. a new perspective.

Sir kindly answer the above questions as i faced the same doubts as well. Even today was wondering what to do since tata steel and bata opened above the buy and stayed there through the day. Thank you

Hi Bramesh

I have been observing and paper trading the intraday calls for the last 20 odd sessions. at the outset i must say that the quality of calls / analysis is great not only in terms of win% but also in terms of risk:reward, . However i must add that in the rules the point u mentioned about waiting for 1-2 mins at the trade initiation level, that is not working out. in fact of all the calls in last 20 days, almost 80% of the calls get triggered between 9.15 to 9.18 am. my queries are :

1. when u say for eg buy above 125 with SL at 123 and if it opens @ 127 and stays there… so does it mean that if u are comfortable with 127 – 123 = 4 pts risk u can take the trade at any point above the level mentioned 125 , i mean buying @ 125 is not sacrosanct ?

2. when a trade meets T1 OR T2 , do u keep the stops @ original level or trail to cost as far as your own tracking is concerned ? this i am sure would of course be individual and their own risk appetite specific in real world. i am only asking as far as your tracking which u publish.

3. generally the pre opening price gives an idea that for each of the 3 calls for the day the opening will trigger the buy or the sell trade , so would you advise that if indication is that it will open around or above the buy price, we keep a limit order in the system before the mkt opening….

Thanks !!

Intraday trading is all about how fast are your reflexes, how fast can u react after 9:15 AM.

1. Depends on Risk Profile of trader

2. Depends on the beta and price action of stock

3. I trade only with market order never see pre opening price.

As a trader you should develop your own rules based on risk profile. every trader has a diffrent way of trading and you need to hone it, based on your comfort level.

Rgds,

Bramesh