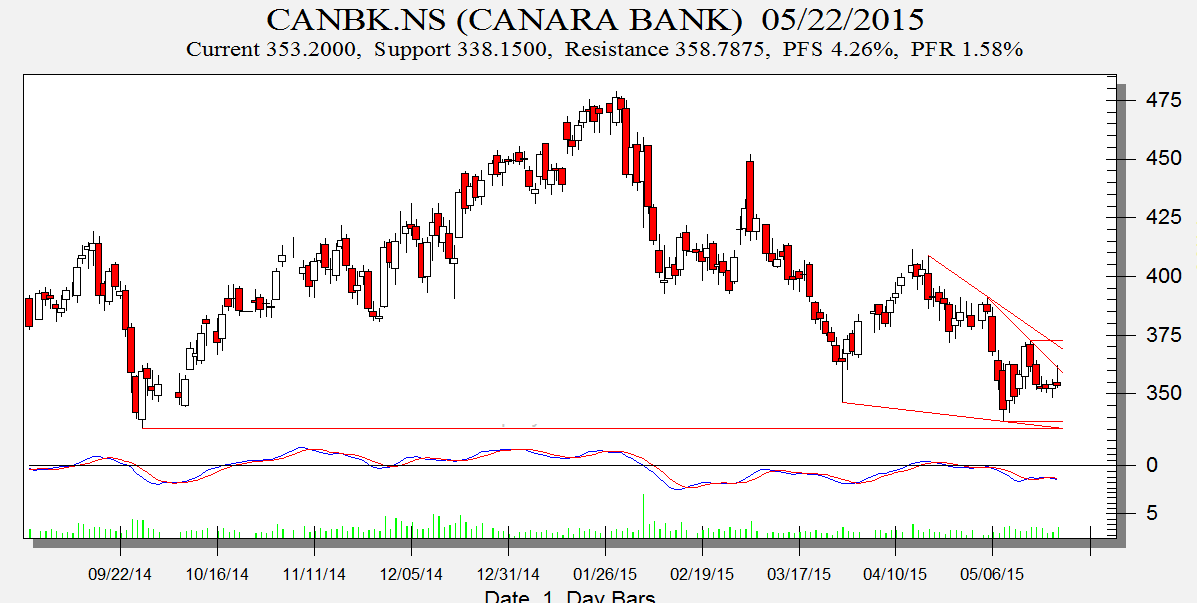

Canara Bank

Intraday Traders can use the below mentioned levels

Buy above 356 Tgt 359.5,365 and 369 SL 353

Sell below 352 Tgt 349.4,345.7 and 340 SL 354

AB Nuvo

Any close below 1830 short term target 1750

Intraday Traders can use the below mentioned levels

Buy above 1841 Tgt 1852,1862 and 1872 SL 1833

Sell below 1820 Tgt 1809,1789 and 1770 SL1830

Century Textile

Any close below 665 short term target 644/631/623

Intraday Traders can use the below mentioned levels

Buy above 676 Tgt 679.5,685 and 695 SL 672

Sell below 668 Tgt 663,653 and 647 SL 672

HDFC Bank

Any close below 1021 short term target 1008/987

Intraday Traders can use the below mentioned levels

Buy above 1025 Tgt 1029,1034 and 1040 SL 1022

Sell below 1018 Tgt 1013,1008 and 1000 SL 1024

How to trade Intraday and Positional Stocks Analysis — Click on this link

Performance sheet for Intraday and Positional is updated for March Month, Intraday Profit of 2.26 Lakh and Positional Profit of 2.66 Lakh

http://tradingsystemperformance.blogspot.in/

http://stockpositionaltrading.blogspot.in/

- All prices relate to the NSE Spot/Cash Market

- Calls are based on the previous trading day’s price activity.

- Intraday call is valid for the next trading session only unless otherwise mentioned.

- Stop-loss levels are given so that there is a level below/above, which the market will tell us that the call has gone wrong. Stop-loss is an essential risk control mechanism; it should always be there.

- Book, at least, part profits when the prices reach their targets; if you continue to hold on to positions then use trailing stops to lock in your profits.

Follow on Facebook during Market Hours: https://www.facebook.com/pages/Brameshs-Tech/140117182685863

Please also read the detailed Disclaimer mentioned in the Right side of Blog.

Hi Bramesh,

I need ur help i got stuck in cancara bank, i entered at right price but couldn’t come out after the stoploss triggered as there was nonstop fall.

could u pls suggest me what to do now?

shall i wait for the bounce or come out of the position as per tomorrow’s opening??

Loss need to be cut asap

Thanx Bramesh, tomm i’ll try to come out of the position asap

Dear Bramesh, This post is just to appreciate your calls and please take it as a token of thanks from my side..Your calls are so accurate even if a call hits a SL and you change the direction, I think it will pay you. E.g. in Century Textiles today, I bought at 676 and the stock took a U turn hitting SL at 668. But I sold at 667 again and it has hit all targets. You are simply superb and I am looking forward to a course as soon as possible (Just that I am not getting enough time on weekends, my bad 🙁 )

Dear Saurabh,

Its your discipline which is paying the rewards 🙂

Rgds,

Bramesh

Modesty is the biggest virtue.. 🙂

Sir, any idea on SBI. i am holding short in sbi fut at 283. kindly help me out sir. any short term tgts or support or resistance levels.